MIDAS GOLD UPDATES MINERAL RESOURCES FOR THE GOLDEN MEADOWS PROJECT, IDAHO

Indicated Mineral Resources increase 29% to more than 5.4 million oz of Gold

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) today updated its mineral resource estimates for the Golden Meadows Project (the “Project”), located in the historic Stibnite-Yellow Pine mining district in Idaho. These updated estimates incorporate more than 45,000m of additional drilling completed since 2012 that was focused on converting mineral resources from the inferred to the indicated category within the limits of mining contemplated in the 2012 Preliminary Economic Analysis (“2012 PEA”). The 5.46 million oz of gold contained in the indicated mineral resources category represents an increase of 29% over previous estimates published in the 2012 PEA. The Project also contains approximately 1.07 million oz of gold in the inferred mineral resource category.

“Midas Gold is in the process of designing a sustainable mining project, based on identified mineral resources, that takes a holistic approach to the potential redevelopment, remediation and restoration of this extensively mined brownfields site,” said Stephen Quin, President and CEO of Midas Gold Corp. “This approach recognises the importance of the potential economic benefits from such a project to Idaho and its local communities and the importance of the natural environment, especially in respect of water quality and fisheries, to all stakeholders.” The 5.46 million oz indicated mineral resources provides the basis for a Pre-Feasibility Study (“PFS”) scheduled to be published later in the year. “The PFS will also detail a number of preferred options for the Project, based on environmental, technical and economic considerations,” he said. “In addition to the preferred project design options, alternative options will be identified in order that stakeholders may have informed discussions regarding the Project. Depending on the outcome of the PFS and such discussions, Midas Gold may choose to submit a permit application for development of the Project.”

Table 1: Consolidated Mineral Resource Statement (1,2,3,4) for the Golden Meadows Project

Total(5) Open Pit Oxide + Sulfide Mineral Resources - Base Case Estimate

| Classification | Tonnage (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%)(5) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|

| Indicated | 104,506 | 1.63 | 5,464 | 2.65 | 8,904 | 0.07 | 155,169 |

| Inferred | 25,168 | 1.32 | 1,066 | 2.15 | 1,743 | 0.05 | 25,908 |

All mineral resources have been estimated in accordance with Canadian Institute of Mining and Metallurgy and Petroleum (“CIM”) definitions, as required under National Instrument 43-101 (“NI43-101”).

Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate potential for economic viability, as required under NI43-101; mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability - see “Compliance with NI43-101” below. All figures are rounded to reflect the relative accuracy of the estimate and therefore numbers may not appear to add precisely.

Open pit sulfide mineral resources are reported at a cut-off grade of 0.75 g/t Au. Cut-off grades are based on a price of US$1,400 per ounce of gold and a number of operating cost and recovery assumptions, plus a contingency (see details below).

Open pit oxide mineral resources are reported at a cut-off grade of 0.45 g/t Au. Cut-off grades are based on a price of US$1,400 per ounce of gold and a number of operating cost and recovery assumptions, plus a contingency (see details below).

“Total” project mineral resources include those resources from the Yellow Pine, Hangar Flats, West End and Historic Tailings deposits.

“The updated mineral resource estimate for the Project incorporates the results of an extensive resource definition drilling program and resulting improved understanding of geologic controls on mineralization within our three primary deposits,” said Mr. Quin. “The significant increase in indicated mineral resources, especially within the flagship Yellow Pine deposit provides the foundation for completion of a preliminary feasibility study for this existing brownfields site,” he noted. “Some inferred mineral resources were not converted, or were eliminated, especially around the margins of the deposits, much of which did not fall within the mining plan laid out in the 2012 PEA anyway. We also believe that the improved geologic knowledge provides for greater confidence in our mineral resource estimate and greatly reduces risk as we advance the Project.”

The mineral resource estimates incorporate the results of more than 45,000m of new drilling completed since the cut-off date for the 2012 PEA. As discussed in prior news releases, this new drilling focused on the highest financial margin material, within the mining limits indicated in the 2012 PEA that was based on the results of the preliminary economic analysis in the 2012 PEA. This analysis supported a focus within the Yellow Pine deposit and within a smaller conceptual pit shell at Hangar Flats. Accordingly, indicated mineral resources for gold increased by 52% in Yellow Pine, 18% at Hangar Flats and remained approximately the same at the West End deposit, where only minimal drilling was completed. In addition, the indicated mineral resources for antimony increased by 32% at Yellow Pine and by 22% at Hangar Flats. The West End mineral resource was expanded by drilling, but this increase was largely offset by resource reductions associated with tighter search ellipses and more conservative modeling parameters regarding the use of historical data with incomplete gold fire-assays. Reductions in the mineral resources occurred primarily where the 2012 PEA estimates allowed extrapolation of grade at depth and around the periphery of the deposits based on the sparse drill data available at the time. Better structural constraints and additional drill hole information incorporated into the updated models now provide for a more conservative estimate, with better controls on gold mineralization.

Antimony Sub-Domains

The Yellow Pine and Hangar Flats deposits contain zones with substantially elevated antimony-silver mineralization, defined as containing greater than 0.1% antimony, relative to the overall mineral resource. The existing historic tailings resource also contains elevated concentrations of antimony. As discussed in a news release dated August 20, 2014, metallurgical testing completed in 2013-14 was successful in producing a marketable antimony concentrate. These higher grade antimony zones are reported separately in the table below to illustrate the potential for antimony production from the Project, and are contained within the overall mineral resource estimates reported herein. Antimony zones are reported only if they lie within gold mineral resource estimates.

Table 2: Antimony Sub-Domains Consolidated Mineral Resource Statement(1,2)

| Classification | Tonnage (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000’s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|

| Indicated | |||||||

| Hangar Flats | 3,901 | 2.06 | 258 | 7.23 | 907 | 0.59 | 50,729 |

| Yellow Pine | 6,080 | 2.27 | 443 | 6.99 | 1,367 | 0.58 | 77,841 |

| Historic Tailings | 2,583 | 1.19 | 99 | 2.95 | 245 | 0.17 | 9,648 |

| Total Indicated | 12,564 | 1.98 | 800 | 6.23 | 2,518 | 0.50 | 138,218 |

| Inferred | |||||||

| Hangar Flats | 1,186 | 1.94 | 74 | 8.05 | 307 | 0.68 | 17,844 |

| Yellow Pine | 409 | 1.36 | 18 | 4.86 | 64 | 0.50 | 4,552 |

| Historic Tailings | 140 | 1.23 | 6 | 2.88 | 13 | 0.18 | 563 |

| Total Inferred | 1,735 | 1.74 | 97 | 6.88 | 384 | 0.60 | 22,959 |

Antimony mineral resources are reported as a subset of the total mineral resource within the conceptual pit shells used to constrain the total gold mineral resource in order to demonstrate potential for economic viability, as required under NI43-101; mineralization outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability - see “Compliance with NI43-101” below. All figures are rounded to reflect the relative accuracy of the estimate.

Open pit antimony sulfide mineral resources are reported at a cut-off grade 0.1% antimony within the overall 0.75 g/t Au gold cut-off. Cut-off grades are based on a price of US$1,400 per ounce of gold, $4.50/lb antimony and a number of operating cost and recovery assumptions, plus a contingency (see details below). The antimony subdomain is further limited to discrete zones of mineralization with grades that exceed 0.1% antimony.

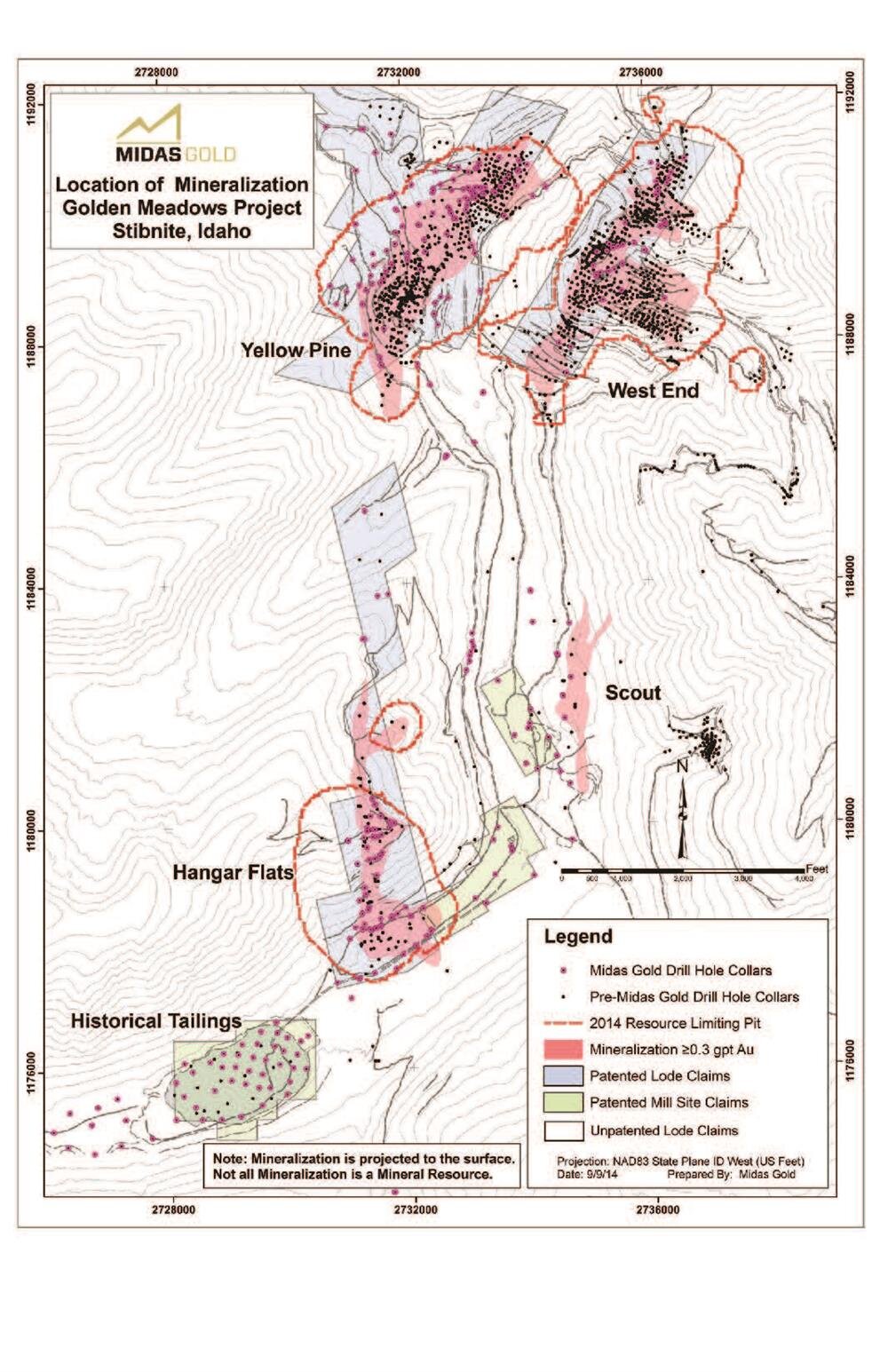

Mineral Resource Estimates by Deposit

The mineral resource estimate for the Project encompasses four separate deposits: Yellow Pine, Hangar Flats, West End and historic tailings. Each deposit was modelled based on a combination of Midas Gold and pre-Midas Gold drilling, with the latter information being used only where sufficient confidence was obtained to support its use. Details of each of the mineral resource estimates are summarized below.

Yellow Pine Mineral Resource Estimate

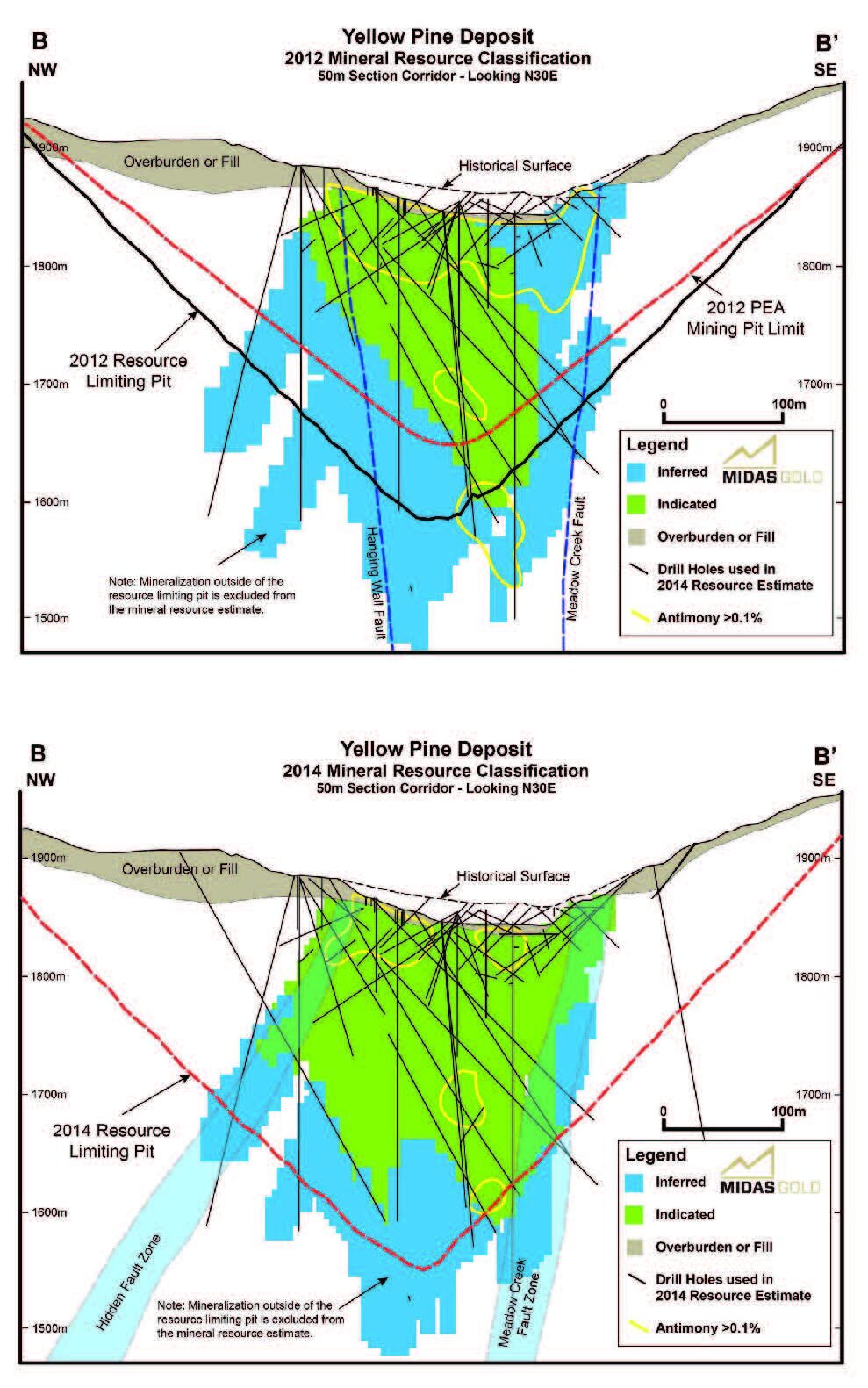

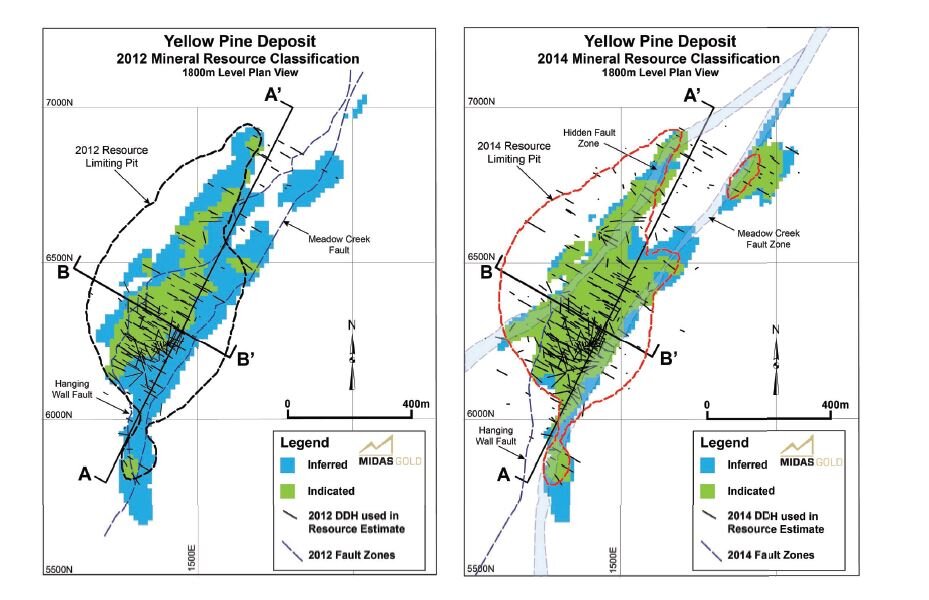

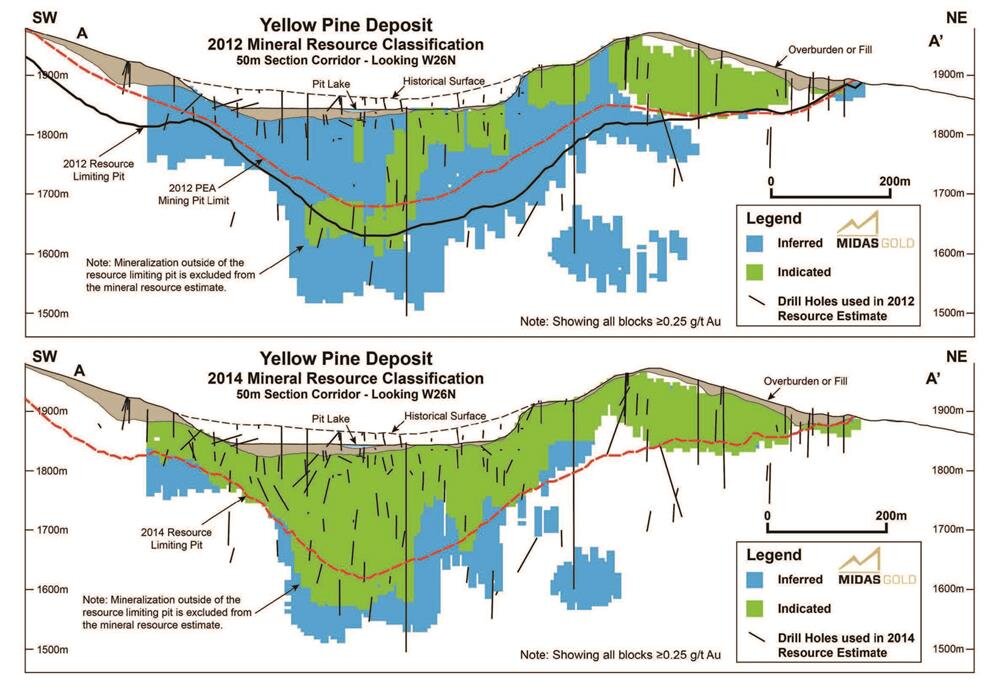

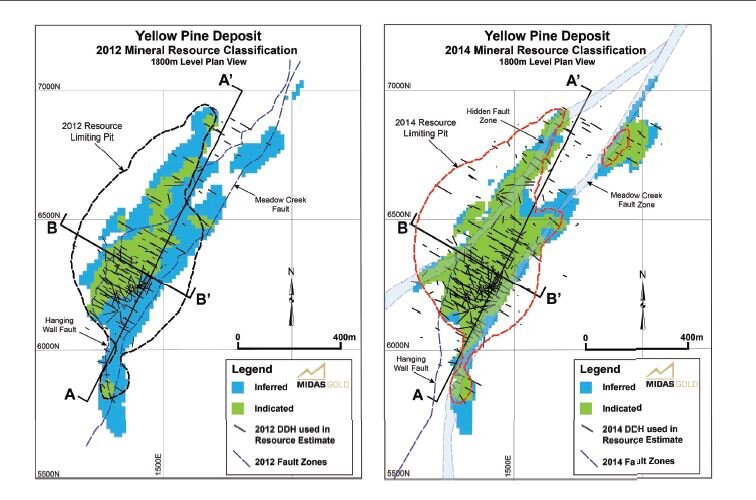

The mineral resource estimate for the Yellow Pine deposit is summarized in the table below and is based on 74,926m of drilling in 633 holes, including 46,080m of drilling in 226 holes by Midas Gold and the balance drilled by others. Additional drilling, including extensive use of oriented core by Midas Gold since the 2012 PEA, has made possible significantly improved and more detailed geologic modeling, resulting in improved understanding of controls on mineralization. The principal changes to the current mineral resource estimate for Yellow Pine versus that in the 2012 PEA are (1) the recognition of fault control on mineralization in some areas, particularly on the eastern side of the main portion of the Yellow Pine deposit, which resulted in the elimination of some previously interpreted mineralization, and (2) the recognition of the Hidden Fault on the west side of the deposit, which also plays an important role in controlling mineralization. In addition, after extensive analysis of the various generations of drilling, it was decided to limit the influence of the underground Bradley-era drilling (1939 - 1953) as compared to other data sets, which constrains the higher grade gold-antimony intercepts in the upper portion of the Yellow Pine deposit. The net result of the mineral resource estimate for Yellow Pine is a 52% increase in gold contained in indicated mineral resources, and an 80% reduction in gold contained in inferred mineral resources, the latter a result of the conversion of ounces to the indicated category and a combination of additional drilling, improved geologic controls and limits placed on the influence of the Bradley-era data.

Table 3: Yellow Pine Mineral Resource Statement

Open Pit Sulfide at a 0.75 g/t Au Cut-off (1,2)

| Classification | Tonnage (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|

| Indicated | 44,559 | 1.93 | 2,762 | 2.89 | 4,133 | 0.09 | 84,777 |

| Inferred | 9,031 | 1.31 | 380 | 1.50 | 437 | 0.03 | 5,535 |

Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate potential for economic viability, as required under NI43-101; mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability - see “Compliance with NI43-101” below. All figures are rounded to reflect the relative accuracy of the estimate.

Open pit sulfide mineral resources are reported at a cut-off grade of 0.75 g/t Au. Cut-off grades are based on a price of US$1,400 per ounce of gold and a number of operating cost and recovery assumptions, plus a contingency (see details below).

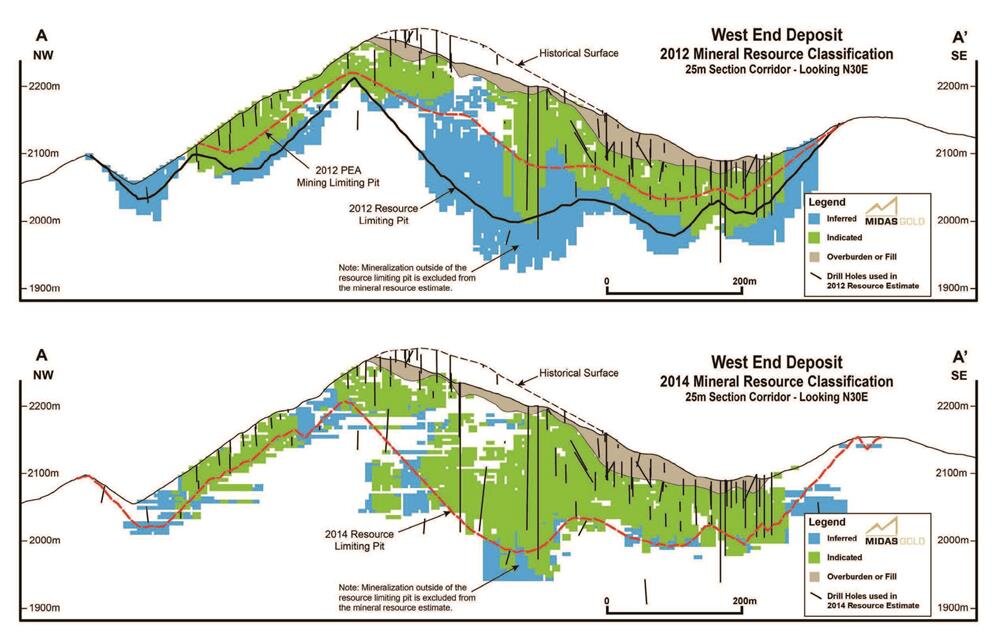

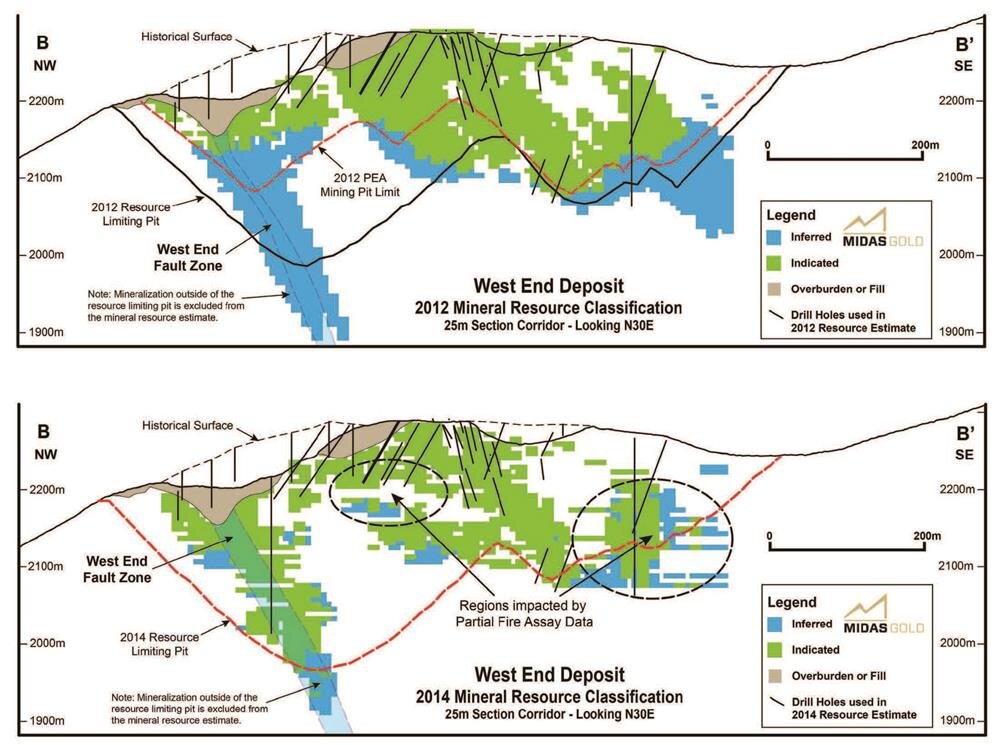

West End Mineral Resource Estimate

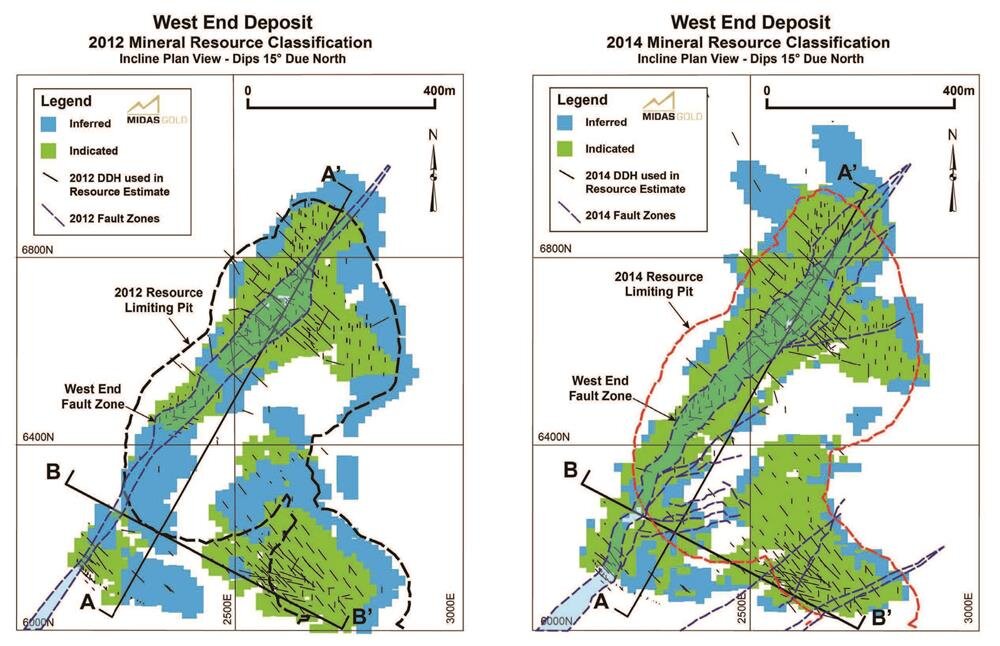

The updated West End mineral resource estimate tabulated below is based on 67,762m of drilling in 674 holes, including 11,856m of drilling in 53 holes by Midas Gold and the balance drilled by others. As a result of limited additional drilling, including some oriented core by Midas Gold since the 2012 PEA, a more detailed geologic model has been completed, resulting in improved understanding of controls on mineralization. The updated geologic model includes solid modeling of the entire metasedimentary sequence, an improved representation of the West End Fault Zone (“WEFZ”), addition of splay structures which control mineralization in the hanging wall of the WEFZ, and an improved representation of granitic intrusive bodies. The updated mineral resource estimate for the West End deposit also used 3,312 new cyanide gold assays obtained for Midas Gold drill holes, unique variogram models for cyanide soluble gold mineralization, an assessment of changes in mineralization across litho-stratigraphic contacts, and more conservative search ellipses for the second pass grade interpolation. In addition, after extensive analysis of the various generations of drilling, it was decided to use available assays for specific drill campaigns, whether cyanide-assays or fire-assays, as opposed to interpolating grades from partial fire-assay data, which was deemed subject to selective sampling. This approach likely underestimates the overall in situ gold content of the West End deposit, but is a more conservative approach and appropriate for use in a PFS. The net result of the mineral resource estimate for West End is a 1.2% increase in gold contained in indicated mineral resources, and a 48% reduction in gold contained in inferred mineral resources. While additional indicated mineral resources were realized from new Midas Gold drilling within the WEFZ and along subsidiary splay structures, these additions were largely offset by decreases associated with more conservative modeling methodologies, improved geologic controls and more conservative treatment of selective gold fire-assay sample data.

Table 5: West End Mineral Resource Statement

Open Pit Oxide + Sulfide (1,2,3)

| Classification | Material Type | Cut-off Grade (g/t Au) | Tonnage (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|---|---|

| Indicated | Oxide | 0.45 | 8,448 | 0.80 | 216 | 1.22 | 332 | 0.010 | 1,769 |

| Indicated | Sulfide | 0.75 | 27,526 | 1.45 | 1,285 | 1.40 | 1,235 | 0.008 | 4,794 |

| Total Indicated | 35,974 | 1.30 | 1,501 | 1.35 | 1,567 | 0.008 | 6,563 | ||

| Inferred | Oxide | 0.45 | 2,057 | 0.76 | 50 | 0.40 | 27 | 0.004 | 168 |

| Inferred | Sulfide | 0.75 | 6,489 | 1.28 | 267 | 0.77 | 161 | 0.006 | 916 |

| Total Inferred | 8,546 | 1.15 | 317 | 0.68 | 187 | 0.006 | 1,083 |

Mineral resources are reported in relation to a conceptual pit shell in order to demonstrate potential for economic viability, as required under NI43-101; mineralization lying outside of these pit shells is not reported as a mineral resource. Mineral resources are not mineral reserves and do not have demonstrated economic viability - see “Compliance with NI43-101” below. All figures are rounded to reflect the relative accuracy of the estimate.

(2) Open pit sulfide mineral resources are reported at a cut-off grade of 0.75 g/t Au. Cut-off grades are based on a price of US$1,400 per ounce of gold and a number of operating cost and recovery assumptions, plus a contingency (see details below).

(3) Open pit oxide mineral resources are reported at a cut-off grade of 0.45 g/t Au. Cut-off grades are based on a price of US$1,400 per ounce of gold and a number of operating cost and recovery assumptions, plus a contingency (see details below).

Cut-Off Grade and Prospects for Economic Extraction

In order to establish prospects for economic extraction, as required by NI43-101, conceptual pit shells were developed in MineSight(r) software by Garth Kirkham, P.Geo. and QP, using a Lerchs-Grossman algorithm and input parameters derived from preliminary cost estimates associated with pre-feasibility level engineering studies, as shown in the table below.

Table 8: Pit Optimization Parameters by Deposit

| Input Parameters | Units | Yellow Pine | Hangar Flats | West End | Historic Tailings | Notes |

|---|---|---|---|---|---|---|

| Mining Cost - Resource | $/tonne mined | 1.75 | 1.75 | 1.75 | 1.75 | Includes mining G&A |

| Mining Cost - Waste | $/tonne mined | 1.90 | 1.50 | 1.75 | 0.50 | Includes mining G&A |

| Oxide Processing Cost | $/tonne mined | N/A | N/A | 9.00 | N/A | Excludes G&A costs |

| Oxide Au Recovery | % | N/A | N/A | 84 * AuCN/ AuFA+8.52(1) | N/A | Formula based on PFS level metallurgical test results |

| Oxide / Sulfide Boundary | CN Au : FA Au | N/A | N/A | 0.70 | N/A | |

| Sulfide Processing Cost | $/tonne milled | 16.50 | 16.50 | 16.50 | 16.50 | Excludes G&A costs |

| Sulfide Au Recovery | % | 93.0 | 92.0 | 88.0 | 80.0 | |

| Dore Transport Cost | $/oz Au | 1.15 | 1.15 | 1.15 | 1.15 | |

| Dore Refining Cost | $/oz Au | 1.00 | 1.00 | 1.00 | 1.00 | |

| G&A + Rehabilitation Cost | $/tonne milled | 3.50 | 3.50 | 3.50 | 3.50 | |

| Pit Slopes | degrees | 48 | 48 | 48 | N/A | |

| Au Payability | % | 99.5 | 99.5 | 99.5 | 99.5 | |

| Au Selling Price - Base Case | $/oz | 1,400 | 1,400 | 1,400 | 1,400 | |

| Mining dilution | % | 0 | 0 | 0 | 0 | |

| Mining recovery | % | 100 | 100 | 100 | 100 |

AuCN is cyanide leachable gold, AuFA is total gold.

This led to a calculated cut-off grade of approximately 0.5g/t Au for sulfides, and lower for oxides. However, in order to provide a level of conservatism and to provide consistency with prior reporting of mineral resource estimates, Midas Gold increased the base case cut-off grades to 0.45g/t gold for oxides and 0.75g/t for sulfides. Only mineral resources above these cut-offs and within the resource-limiting pits are reported; mineralization falling below this cut-off grade or outside the resource-limiting pit is not reported, no matter what the grade. Sensitivity to cut-off grade is reported in Table 7 above.

Assumptions used to derive the cut-off grades and define the resource-limiting pits are estimated in order to meet the NI43-101 requirement for mineral resource estimates to demonstrate “reasonable prospects for eventual economic extraction”. The cut-off grades to be used in the upcoming PFS may vary from those used to limit the mineral resources reported herein, as the inputs to that study are determined. No inference is implied in the changes to the cut-off grade assumptions from the prior mineral resource estimates as to what will be used in the upcoming PFS, as those assumptions remain to be determined.

Updated Technical Report and Upcoming PFS

The details of four mineral resource estimates for Yellow Pine, Hangar Flats, West End and historic tailings will be provided in a NI43-101 Technical Report to be filed in conjunction with the completion of the PFS scheduled for later in 2014.

With the completion of the mineral resource estimates contained herein, the recent announcement of the results of the metallurgical test program and the other engineering, design and baseline work completed, Midas Gold and its consultants are currently completing mine planning, estimates of capital and operating costs, and other components of the planned PFS. The PFS is anticipated to be completed in Q4/2014 and results will be announced when appropriate, and will be detailed in the required Technical Report.

2014 Mineral Resource Estimate Methodology

The mineral resource estimates for Yellow Pine, Hangar Flats and West End were prepared to industry standards and best practices and verified by Garth Kirkham, P.Geo. and a Qualified Person for the purposes of NI43-101. The mineral resources were estimated using commercial mine-modeling and geostatistical software by third party consultants. Each deposit was segregated into multiple estimation domains based on geologic models completed under supervision of Midas Gold’s Field Operations Manager Richard Moses, CPG, and Exploration Manager Chris Dail, CPG. Gold block grades were estimated from capped composited samples in multiple passes within 0.25g/t grade shells. The majority of mineral resources were estimated using ordinary kriging interpolation with octant or sector sample requirements, but gold in peripheral domains at Hangar Flats, intrusive hosted gold at the West End, and antimony mineralization occurring outside of grade shells at Hangar Flats and Yellow Pine were estimated using inverse distance weighting interpolation methods, where this approach was deemed more appropriate. Search ellipse anisotropy and orientation were based on variogram and/or correlogram models with first pass major axis search distances generally 40-60m, and second pass distances generally 100-150m. Some mineral resources at Hangar Flats were estimated in three passes. Midas Gold and its consultants conducted extensive statistical analyses to assess the quality of the pre-1953 drill hole data. Although analyses and subsequent confirmatory drilling have generally shown the data to be of good quality, use of this historical data presents certain risks in mineral resource estimation due to historical drilling, sampling and assaying methodologies. At Hangar Flats and Yellow Pine, range-restricted searches and sample selection filters were employed to limit the influence of certain pre-1953 historical small-diameter core holes. Model sensitivities indicate a reduction in contained gold of approximately 4% for Yellow Pine if pre-1953 data is excluded from the current estimates. At Hangar flats, the influence of pre-1953 data was tracked for each block and was only 3% for indicated resources, with 97% influence from modern-era data, primarily MGI drilling. Antimony, silver and cyanide-soluble gold were estimated using methodologies similar to the gold estimates. Bradley Mining Company data was excluded from use in the antimony estimate at Yellow Pine and was used only in the second pass for antimony estimation at Hangar Flats. Mineral resource classification for gold was based on various parameters, including number of samples, number of drill holes, average and nearest distance to composites, influence of pre-1953 data, kriging variance and single block kriged results. Antimony and silver are not classified separately and are reported based on gold classification. A full description of the modeling methodologies for each deposit will be included in a technical report scheduled for release in late 2014, to be filed in conjunction with completion of PFS for the Project. Modeling methodologies for the historic tailings mineral resource estimates are discussed in a news release dated October 28th, 2013.

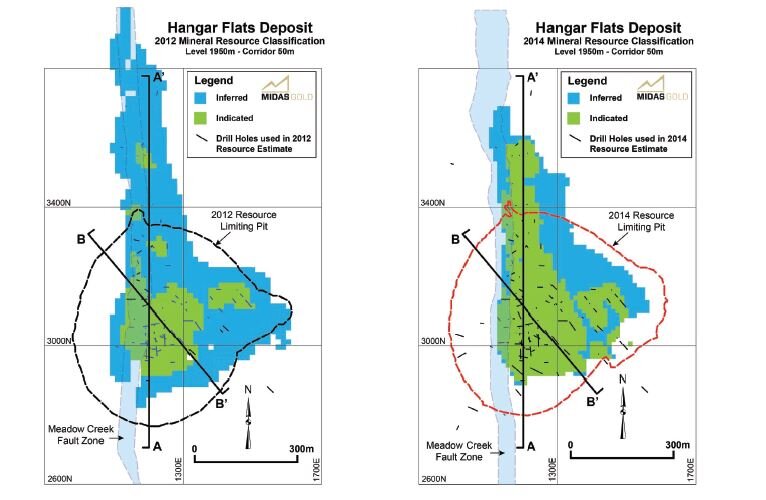

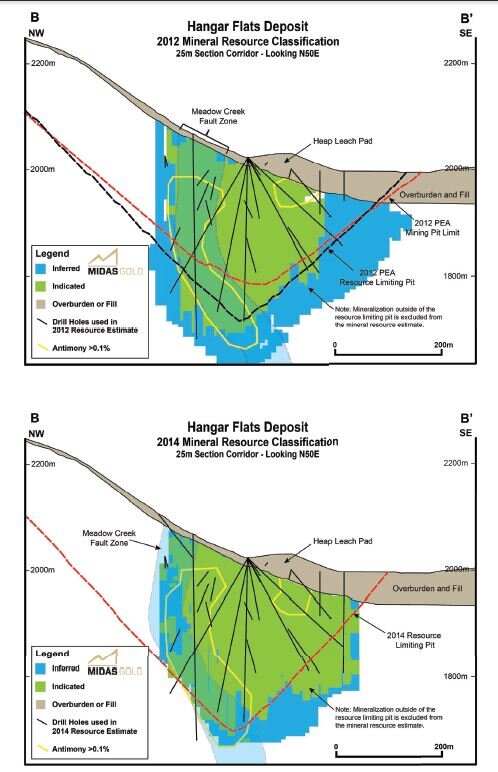

Illustrations

Diagrams illustrating the locations of each of the mineral deposits for which mineral resource estimates are reported herein, including plans and sections showing changes from the 2012 mineral resource estimates. Click images to enlarge.

Compliance with National Instrument 43-101

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 (“NI43-101”) and reviewed and approved by Stephen P. Quin, P.Geo., President and CEO of Midas Gold Corp., and a Qualified Person. The exploration and drilling activities at Golden Meadows were carried out under the supervision of Richard Moses, C.P.G., Field Operations Manager for the Golden Meadows Project and Chris Dail, C.P.G., Exploration Manager for the Golden Meadows Project, both Qualified Persons.

Garth Kirkham, P.Geo., of Kirkham Geosystems Ltd. is the Qualified Person, as defined in National Instrument 43-101, responsible for the mineral resource estimates as reported herein. He has read and approved the relevant technical portions of this news release related to the mineral resource estimates for which he is responsible.

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to the measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied.

The Project mineral resources are contained within areas that have seen historic disturbance resulting from prior mining activities. In order for Midas Gold to advance its interests, the Project will be subject to a number of Federal, State and local laws and regulations and will require permits to conduct its activities. However, Midas Gold is not aware of any environmental, permitting, legal or other reasons that would prevent it from advancing the Project.

About Midas Gold

Midas Gold Corp., through its wholly owned subsidiaries Midas Gold, Inc. and Idaho Gold Resources, LLC, is focused on the exploration and, if warranted, development of deposits in the Stibnite-Yellow Pine district of central Idaho. The principal gold deposits identified to date within the Project are the Hangar Flats, West End and Yellow Pine deposits, all of which are associated with important structural corridors, as well as a mineral resource contained in historic tailings.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future exploration activities on the Corporation’s properties; success of exploration activities; permitting time lines and requirements, requirements for additional capital, requirements for additional water rights and the potential effect of proposed notices of environmental conditions relating to mineral claims; planned exploration and development of properties and the results thereof; planned expenditures and budgets and the execution thereof. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “budget”, “scheduled”, “estimates”, “anticipates”, “potential” or “does not anticipate”, “believes”, “anomalous” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “occur” or “be achieved”. Statements concerning mineral resource estimates may also be deemed to constitute forward-looking statements to the extent that they involve estimates of the mineralization that may be encountered if the Golden Meadows Project is developed. In making the forward-looking statements in this news release, the Corporation has applied several material assumptions, including, but not limited to, that the current exploration and other objectives concerning the Golden Meadows Project can be achieved and that its other corporate activities will proceed as expected; that the current price and demand for gold will be sustained or will improve; that general business and economic conditions will not change in a materially adverse manner and that all necessary governmental approvals for the planned exploration on the Golden Meadows Project will be obtained in a timely manner and on acceptable terms; the continuity of the price of gold and other metals, economic and political conditions and operations. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, risks related to the availability of financing on commercially reasonable terms and the expected use of proceeds; operations and contractual obligations; changes in exploration programs based upon results of exploration; changes in estimated mineral resources; future prices of metals; availability of third party contractors; availability of equipment; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry; environmental risks, including environmental matters under U.S. federal and Idaho rules and regulations; impact of environmental remediation requirements and the terms of existing and potential consent decrees on the Corporation’s planned exploration on the Golden Meadows Project; certainty of mineral title; community relations; delays in obtaining governmental approvals or financing; fluctuations in mineral prices; the Corporation’s dependence on one mineral project; the nature of mineral exploration and mining and the uncertain commercial viability of certain mineral deposits; the Corporation’s lack of operating revenues; governmental regulations and the ability to obtain necessary licenses and permits; risks related to mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; currency fluctuations; changes in environmental laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may increase costs of doing business and restrict operations; risks related to dependence on key personnel; and estimates used in financial statements proving to be incorrect; as well as those factors discussed in the Corporation’s public disclosure record. Although the Corporation has attempted to identify important factors that could affect the Corporation and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, the Corporation does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Note to US Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43 101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures. “Indicated mineral resource” and “inferred mineral resource” have a great amount of uncertainty as to their existence and a great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. Accordingly, information contained in this News Release contain descriptions of the Company’s mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.