Press Releases

PERPETUA ANNOUNCES ANTIMONY SUPPLY AGREEMENT FOR AMBRI BATTERY PRODUCTION

Perpetua’s Antimony Will Power Ambri’s Low-Cost Battery for Long-Duration, Daily Cycling Energy Storage

Committed Amount Sufficient to Generate Over 13 Gigawatt Hours of Storage, Equivalent to Over 8x the Size of the Entire US Energy Storage Market in 2020

Solidifies Perpetua’s Standing as a Leading ESG-Focused Mining Company Enabling the Green Energy Transition & Restoring the Environment

BOISE, ID – Perpetua Resources Corp. (Nasdaq: PPTA / TSX: PPTA) (“Perpetua Resources” or the “Company”) has entered into an agreement (the “Agreement”) to supply a portion of antimony production from the Stibnite Gold Project to Ambri Inc. (“Ambri”), establishing the foundation to help facilitate the decarbonization of energy grids in the U.S. and around the world. Perpetua’s Stibnite Gold Project, located in central Idaho, will provide Ambri with antimony from the only responsible and domestically mined source of the critical mineral in the U.S.

Ambri, a U.S. company, has developed an antimony-based, low-cost liquid metal battery for the stationary, long-duration, daily cycling energy storage market. Ambri batteries combine technological innovation with commercial applications for low-cost, long lifespan and safe energy storage systems that will increase the overall contribution from renewable sources to help enable the transition to green, carbon-free power grids.

“This agreement is a meaningful step in support of the current administration’s goal of achieving 100% clean electricity in the U.S., while prioritizing the domestic manufacturing of battery technology,” said Laurel Sayer, CEO of Perpetua Resources. “Perpetua continues to show how a modern mining company can not only be an essential part of the clean energy value chain, but also be key to the solution to the world’s climate challenges.”

The signing of the Agreement coincides with Ambri’s announcement that it secured $144 million in new financing led by Reliance New Energy Solar Ltd. (a wholly owned subsidiary of Reliance Industries Limited), Paulson & Co. Inc., Bill Gates, Fortistar and Goehring & Rozencwajg Associates. Additionally, Reliance has been chosen as Ambri’s joint venture partner for battery development in India as part of its broader plans to invest $10 billion to develop the Dhirubhai Ambani Green Energy Giga Complex. The capital raise will be used to accelerate the commercialization of Ambri’s leading liquid metal battery and build a domestic manufacturing facility to fundamentally change the way power grids operate.

“We are pleased to announce our partnership with Perpetua, which helps Ambri scale production of its leading battery technology” said Dan Leff, Executive Chairman of Ambri. “Ambri is well positioned to become the lowest cost producer of energy storage batteries, a critical building block enabling the transition to an entirely renewable power grid. Ambri recognizes the strategic importance of antimony as a leading metal in the green energy transformation and supports the responsible production of critical metals, especially within the United States.”

The Agreement contains certain standard commercial terms which contain options for treatment, refining, transport, and tolling charges. The minimum commitment of Perpetua’s antimony production for Ambri’s battery manufacturing is expected to power over 13 Gigawatt hours of battery capacity, which is equivalent to over 8 times the total additions to the entire U.S. energy storage market in 2020.

The Agreement contains a provision for fixed pricing and higher volumes that can be mutually agreed to by both parties. Perpetua and Ambri will also collaborate to identify opportunities to lower carbon emissions in their respective operations with the use of renewable energy combined with battery storage.

“Today’s agreement directly links the redevelopment of the Stibnite Gold Project – and the restoration of the site - to a new battery manufacturing partner that is poised to play a critical role in reducing carbon emissions,” said Sayer. “Our partnership with Ambri significantly increases the strategic and long-term value of our project and breathes further life into our guiding ESG principles.”

Perpetua continues to engage with other potential end users of antimony and will provide updates as they become available.

For further information about Perpetua Resources Corp., please contact:

Jessica Largent

Vice President Investor Relations and Finance

jessica.largent@perpetuacorp.us

Info@perpetuacorp.us

Mckinsey Lyon

Vice President External Affairs

media@perpetua.us

Website: www.perpetuaresources.com

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Further advancing Perpetua Resources’ ESG and sustainable mining goals, the Project will be powered by the lowest carbon emissions grid in the nation and a portion of the antimony produced from the Project will be supplied to Ambri, a US-based company commercializing a low-cost liquid metal battery essential for the low-carbon energy transition. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

About Ambri

Ambri Inc. has developed and is commercializing a new, long-duration battery technology that will enable widespread use of renewable energy sources, reduce electricity costs, and enable power systems to operate more reliably and efficiently. The liquid metal battery project began at MIT in the lab of Professor Donald Sadoway, and the company was formed in 2010 when the project achieved significant technical breakthroughs.

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action including the plans to supply a portion of the expected antimony production from the Stibnite Gold Project to Ambri; and the anticipated benefits of the foregoing. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “anticipates”, “complete”, “expected”, “ensure”, and “potential”, in relation to certain actions, events or results “could”, “may”, “will”, “would”, be achieved. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; that the parties will agree upon mutually acceptable volume and pricing terms; and that general business and economic conditions will not change in a materially adverse manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, changes in laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may result in unforeseen results in the permitting process; risks related to dependence on key personnel; the risk that the parties may not come to final agreement upon volume, pricing and/or other terms or conditions necessary in order to complete the supply of antimony produced from the Stibnite Gold Project to Ambri on mutually acceptable terms; risks of either party being unable to fulfill the terms of the Agreement by virtue of delays and/or other hindrances to reaching production on the part of Perpetua Resources and/or commercialization on the part of Ambri, as applicable; risks related to opposition to the Project; risks related to the outcome of litigation and potential for delay of the Project, as well as those factors discussed in Perpetua Resources’ public disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

U.S. FOREST SERVICE ADVANCES PERPETUA RESOURCES’ PROPOSED ACTION, ELIMINATING ALTERNATIVES, WITH SCHEDULE UPDATE FOR TARGETED NEPA COMPLETION

BOISE, ID – Perpetua Resources Corp. (Nasdaq: PPTA / TSX: PPTA) (Perpetua Resources) today announced that the United States Forest Service (USFS) is advancing Perpetua Resources’ modified proposed action in the National Environmental Policy Act (NEPA) process and updated the permitting schedule for the Stibnite Gold Project (the Project).

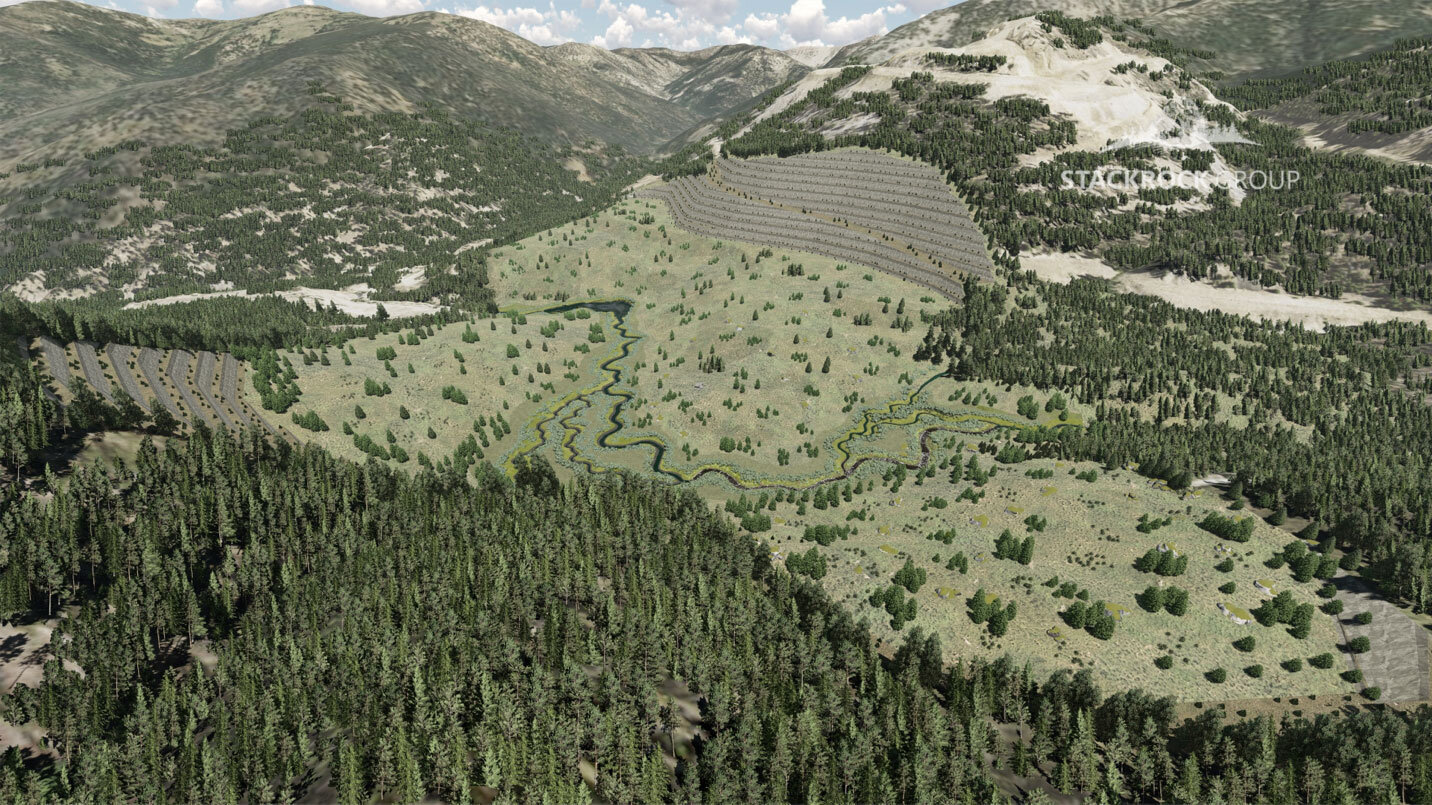

The Project is designed to use responsible mining to develop a world-class gold mine, restore an abandoned mine site, provide the United States with the only domestic source of the critical mineral antimony and contribute to the economic success of Idaho. Perpetua Resources’ modified proposed action was submitted to USFS in December 2020 as the “Modified Plan of Restoration and Operations 2” (ModPRO2) and represents refinements to Alternative 2 of the August 2020 Draft Environmental Impact Statement (DEIS). The refined plan incorporates stakeholder feedback on the DEIS and is designed to reduce the project footprint and improve environmental outcomes. Modifications include the elimination of waste rock storage areas, overall reductions in mined material, additional pit backfilling and restoration, and improvements to water quality and water temperature. The USFS’s decision advances Perpetua Resources’ improved and preferred Project design in the NEPA process and sets the Project on a clear path to a final permitting decision.

Importantly, the USFS will focus on Perpetua Resources’ ModPRO2 and the two identified access routes for the remainder of the NEPA process, eliminating DEIS Alternatives 1 and 3 from further consideration. In order to ensure a full analysis of the refined Project, the USFS plans to issue a targeted Supplemental Draft Environmental Impact Statement (SDEIS) and provide the public and cooperating agencies the opportunity to review and comment on the additional analysis.

“We are pleased the USFS is advancing our proposed action forward and establishing a well-defined path towards a Record of Decision,” said Laurel Sayer, President & CEO of Perpetua Resources. “These actions expressly integrate public input and additional analysis in the process, reduce the Project’s environmental effects, and enhance our restoration and community objectives.”

Perpetua Resources is confident that the additional analysis in the SDEIS will demonstrate the advantages of ModPRO2 and looks forward to continued engagement with the USFS and all relevant stakeholders as the NEPA process is finalized. The Project schedule update includes that the SDEIS will be released in Q1 2022, a Final Environmental Impact Statement (FEIS) and draft Record of Decision will be published in Q4 2022, and a final Record of Decision will be issued in the first half of 2023.

The NEPA process is intended to ensure that federal agencies are informed of a proposed action’s potential environmental impacts before making final decisions regarding the action. The rigorous scientific analysis during the preparation of the DEIS and the comments from the public and cooperating agencies provided during the extended 75-day public comment period brought forward concepts that could improve the environmental outcomes of the Project. Perpetua Resources listened to this feedback, evaluated the feasibility and potential benefits of these concepts, and submitted modifications of the proposed plan (Alternative 2 in the DEIS) to the USFS. The proposed improvements, which reduce the Project footprint and are predicted to improve water quality conditions at the site during and after Project operations, have been incorporated in Perpetua Resources’ 2020 Feasibility Study. These refinements will now be analyzed further in the SDEIS.

“It was important to Perpetua Resources that we listen and act upon feedback provided by community members, tribes, environmental groups and cooperating agencies,” said Sayer. “Incorporating their ideas and additional refinements into the proposed action results in a better Project, is the most efficient way to bring the Project to life longer-term and is the right thing to do for all stakeholders.”

Growing bipartisan support for and the White House’s recent recognition of the importance of responsible domestic production of critical minerals to our national and economic security and green energy transition, signals renewed optimism for projects like the Stibnite Gold Project. The Perpetua Resources team remains committed to advancing the Stibnite Gold Project as efficiently as possible, so its full benefits can be achieved for all stakeholders.

More details about proposed Project refinements can be found here.

For further information about Perpetua Resources Corp., please contact:

Jessica Largent

Vice President Investor Relations and Finance

jessica.largent@perpetuacorp.us

Info@perpetuacorp.us

Mckinsey Lyon

Vice President External Affairs

mailto:media@perpetua.us

Website: www.perpetuaresources.com

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action including actions to be taken by the USFS, the State of Idaho and other government agencies and regulatory bodies; plans with respect to the issuance of an SDEIS; the consideration of difference access routes; the anticipated timing for release of the SDEIS, FEIS, draft ROD and final ROD; predictions regarding improvements to water quality at the site and reduction of the Project footprint and the anticipated benefits and other effects thereof. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “anticipates”, “complete”, “expected” “ensure”, and “potential”, in relation to certain actions, events or results “could”, “may”, “will”, “would”, be achieved. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner; that the review process under the NEPA (including any joint review process involving the USFS, the State of Idaho and other agencies and regulatory bodies) as well as the public review process and SDEIS will proceed in a timely manner and as expected; and that all requisite information will be available in a timely manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, changes in laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may result in unforeseen results in the permitting process; uncertainty surrounding input to be received; risks related to dependence on key personnel; risks related to unforeseen delays in the review process including availability of personnel from the USFS, State of Idaho and other stated, federal and local agencies and regulatory bodies (including, but not limited to, future US government shutdowns); risks related to opposition to the Project; risks related to the outcome of litigation and potential for delay of the Project, as well as those factors discussed in Perpetua Resources’ public disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

PERPETUA RESOURCES ANNOUNCES INCLUSION IN THE RUSSELL 2000 INDEX

BOISE, ID – Perpetua Resources Corp. (Nasdaq: PPTA / TSX: PPTA) (“Perpetua Resources” or the “Company”) today announced that as part of the annual reconstitution of the Russell stock indexes, Perpetua Resources is expected to be included in the Russell 2000® Index and the broad-market Russell 3000® Index effective after the U.S. market opens on June 28, 2021.

“We are pleased to have earned our inclusion in the Russell 2000® Index, one of the most widely cited performance benchmarks for emerging U.S. companies,” said Laurel Sayer, President and CEO of Perpetua Resources. “This is an important milestone for Perpetua Resources after listing on the Nasdaq earlier this year increasing our exposure to a broader investment community as we progress our vision to be the only mined source of the critical mineral antimony in the U.S. and restore an abandoned brownfield site through the redevelopment of our low-cost gold project.”

Membership in the Russell 2000® Index means automatic inclusion in the broader Russell 3000® Index as well as in the appropriate growth and value style indexes. The Russell 3000® Index encompasses the 3,000 largest U.S.-traded stocks by objective, market-capitalization rankings, and style attributes. Membership in these indexes is updated annually and remains in place for one year.

The Russell U.S. Indexes are widely used by investment managers and institutional investors for index funds and as benchmarks for active investment strategies. Approximately US$10.6 trillion in assets are benchmarked against Russell U.S. Indexes. Russell U.S. Indexes are part of FTSE Russell, a leading global index provider.

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources, through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action including the expected inclusion in the Russell 2000® Index and the benefits of such inclusion. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “expected”, “opportunity” and “potential”, in relation to certain actions, events or results “could”, “may”, “will”, “would”, be achieved. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that its corporate activities will proceed as expected; and that general business and economic conditions will not change in a materially adverse manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, changes in laws and regulations and changes in the application of standards pursuant to existing laws and regulations; risks related to dependence on key personnel; risks related to opposition to the Project; and the factors discussed in Perpetua Resources’ public disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Perpetua Resources Signs Collaboration Agreement with U.S. Antimony to Explore Potential to Process Antimony from the Stibnite Gold Project

BOISE, ID – Perpetua Resources Corp. (Nasdaq: PPTA / TSX: PPTA) (“Perpetua Resources” or the “Company”) announces it has signed a collaboration agreement (the “Agreement”) with United States Antimony Corporation (NYSE: UAMY)(“USAC”) to study the potential for processing the Stibnite Gold Project’s antimony concentrate at USAC’s processing facilities. Perpetua Resources is in the process of permitting America’s only mined source of antimony. It is estimated the Stibnite Gold Project has the potential to supply approximately 35 percent of American antimony demand in the first six years of production1.

“Critical minerals are the building blocks of a strong domestic supply chain and play a key role in our transition to a greener economy,” said Laurel Sayer, CEO of Perpetua Resources. “America has the brainpower, spirit of innovation and work ethic to continue to solve some of the world’s toughest problems. However, we lack the minerals and materials we need to bring those solutions to life. Perpetua Resources can play a key role in re-establishing domestic antimony production and protecting America’s energy, technology and defense future.”

The Agreement outlines a plan for the Company to send samples of Stibnite’s antimony concentrate to the facilities owned by USAC to study the viability of entering into a long-term partnership to secure the domestic sourcing of the critical mineral antimony.

Antimony is one of 35 federally designated critical minerals for its use in the national defense, technology and green energy sectors. It has also been named a critical mineral in Canada, Australia and the European Union. Antimony strengthens alloys and makes them resistant to corrosion. It is used in munitions for national defense, flame retardants, wind and hydro turbines, solar panels, large storage batteries, spaceships, cell phones, semiconductors, plastics and cable sheathing.

Currently, there is no mined source of antimony in the United States. The Stibnite Gold Project, along with USAC’s domestic processing abilities, presents an opportunity to re-establish the American supply chain of this critical mineral. China, Russia and Tajikistan control the overwhelming majority of the world’s antimony, supplying more than 90 percent of the global production.2

Perpetua Resources plans to host an in-depth webinar on the critical mineral antimony at 12:00 p.m. EDT or 10:00 a.m. MDT on May 4, 2021. Please RSVP here. More information can also be found at https://perpetuaresources.com/antimony/.

1Based on the results of an independent feasibility study technical report titled “Stibnite Gold Project, Feasibility Study Technical Report, Valley County, Idaho” with an effective date of December 22, 2020 and an issue date of January 27, 2021, which is intended to be read as a whole and sections should not be read or relied upon out of context.

2Source: 2021 USGS Antimony commodity summary

For further information about Perpetua Resources Corp., please contact:

Jessica Largent

Vice President Investor Relations and Finance

jessica.largent@perpetuacorp.us

Info@perpetuacorp.us

Mckinsey Lyon

Vice President External Affairs

media@perpetua.us

Website: www.perpetuaresources.com

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources, through its wholly-owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward-Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action including the potential for processing the Company’s antimony concentrate at USAC’s processing facilities; the potential for re-establishing domestic antimony production in the United States; and the anticipated benefits of the foregoing. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “anticipates”, “complete”, “expected”, “ensure”, and “potential”, in relation to certain actions, events or results “could”, “may”, “will”, “would”, be achieved. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; and that general business and economic conditions will not change in a materially adverse manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, changes in laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may result in unforeseen results in the permitting process; risks related to dependence on key personnel; risks related to opposition to the Project; risks related to the outcome of litigation and potential for delay of the Project, as well as those factors discussed in Perpetua Resources’ public disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

PERPETUA RESOURCES REPORTS RESULTS OF 2021 ANNUAL GENERAL MEETING

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (Nasdaq: PPTA / TSX: PPTA) today announced the results of its annual general meeting (the “AGM”), which was held online through a virtual meeting platform on April 16, 2021.

A total of 34,386,731 common shares were represented at the AGM, or 72.30% of the votes attached to all outstanding shares at the Company’s record date of March 1, 2021. The Company’s shareholders voted in favor of the election of all director nominees listed in the Company’s management information proxy circular. Detailed results of the vote for the election of directors are as follows:

| Name of Nominee | Votes For | Votes Withheld | Total Votes* | Percentage of Votes For* | Percentage of Votes Withheld* |

| Marcelo Kim | 31,088,758 | 352,474 | 31,441,232 | 98.88% | 1.12% |

| Chris Papagianis | 31,360,342 | 80,890 | 31,441,232 | 99.74% | 0.26% |

| Laurel Sayer | 31,361,106 | 80,126 | 31,441,232 | 99.75% | 0.25% |

| Jeff Malmen | 31,362,367 | 78,865 | 31,441,232 | 99.75% | 0.25% |

| Chris Robison | 31,363,392 | 77,840 | 31,441,232 | 99.75% | 0.25% |

| Bob Dean | 31,362,398 | 78,834 | 31,441,232 | 99.75% | 0.25% |

| David Deisley | 31,359,982 | 81,250 | 31,441,232 | 99.74% | 0.26% |

| Alex Sternhell | 31,358,486 | 82,746 | 31,441,232 | 99.74% | 0.26% |

* Not all shares were voted in respect of all resolutions therefore the combined number of shares voted for or withheld (and corresponding percentages) may not add up to the total shares represented at the AGM.

The directors were elected to hold offices until the next annual meeting of shareholders or until their successors are elected or appointed.

The Company’s shareholders also approved the appointment of Deloitte LLP, Chartered Accountants, as the auditors of the Company for the fiscal year ending December 31, 2021 (99.90% voted in favor).

The Company’s shareholders also approved the adoption of a new omnibus equity incentive plan (98.32% voted in favor).

Detailed voting results for the meeting are available on SEDAR at www.sedar.com.

Jessica Largent

Vice President Investor Relations and Finance

jessica.largent@perpetuacorp.us

Info@perpetuacorp.us

Mckinsey Lyon

Vice President External Affairs

media@perpetua.us

Website: www.perpetuaresources.com

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

PERPETUA RESOURCES WORKS ALONGSIDE COMMUNITY TO SUPPORT INDEPENDENT WATER QUALITY MONITORING PROGRAM

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (Nasdaq: PPTA / TSX: PPTA) (Perpetua Resources or the company) is advancing its ESG goals to further bring transparency to its Stibnite Gold Project (project) by participating in a water quality monitoring program led by local citizens. The Independent Water Monitoring Program (IWMP) is an initiative of the Stibnite Advisory Council, which represents eight local communities surrounding the proposed Stibnite Gold Project. The initiative is designed to promote accountability measures around Perpetua Resources’ existing water quality monitoring efforts and give the community access to independent information through conducting third-party data gathering and reporting. Perpetua agreed to participate in the program based upon the company’s long-standing commitment to transparency and its recognition of the important role such programs play in deepening community trust.

“We have always been committed to sharing information about our project with the community,” said Laurel Sayer, CEO of Perpetua Resources Corp. “We applaud the Stibnite Advisory Council for launching this initiative to conduct an independent program at site which will allow community representatives to participate in water monitoring and to verify the conditions facing the abandoned Stibnite Mining District today and into the future. We are proud to continue living our values and further strengthen ourselves as a community partner and a responsible mining company.”

The Stibnite Advisory Council was formed in 2019 and was designed to give community members a voice with Perpetua Resources and an opportunity to resolve challenges and partner on opportunities directly with the company. IWMP is the Council’s largest public initiative to date.

“Having access to clean water and pristine rivers is a value all Idahoans share, and it is one the Stibnite Advisory Council feels a strong obligation to protect,” said Riggins Stibnite Advisory Council member, Bob Crump. “After community members expressed concerns over the potential impacts to water quality and a desire to see more data, we decided it was important to launch the Independent Water Monitoring Program.”

The Stibnite Advisory Council will contract with the University of Idaho’s Water Resources Research Institute to undertake the independent water quality monitoring and reporting. During the first year of the program, the Stibnite Advisory Council will test water temperature, pH levels, conductivity, and elemental presence. All the collected samples will be provided to a lab certified by the Environmental Protection Agency.

The Stibnite Advisory Council plans to monitor ground and surface water at 18 different locations throughout the site. Perpetua Resources will collect samples from these same locations, at the same time as the Stibnite Advisory Council, in order to give Idahoans two comparative data sets. The first samples are currently set to be collected this year.

Initially, monitoring will be conducted by Idaho’s Water Resources Research Institute. However, the Stibnite Advisory Council is working to expand the program to include community representatives who could also observe the sample collection and vouch for the integrity and independence of the process. Once those details are finalized, they will be announced on the Stibnite Advisory Council’s website.

Perpetua has adopted a formal ESG policy and continues to improve and advance the Company’s initiatives regarding environmental stewardship, social responsibility, and good governance. Our ESG policy, and more details about how the company puts these commitments into action, can be found here.

For more details on the program and to view the data when it becomes available, please visit www.StibniteAdvisoryCouncil.com.

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

PERPETUA RESOURCES CAN HELP SECURE U.S. PRODUCTION OF CRITICAL MINERAL ANTIMONY

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (Nasdaq: PPTA / TSX: PPTA) welcomes President Joe Biden’s recently issued Executive Order on securing America’s critical supply chains. Perpetua Resources is in the process of permitting America’s only mined source of antimony, a federally designated critical mineral for its use in the national defense, technology, and energy sectors. The Executive Order declares strengthening the resilience of the American supply chain as a policy of the Administration and requires that over the next one hundred days supply chain risks and policy recommendations be brought forward regarding semiconductor manufacturing, high-capacity batteries, critical minerals, and pharmaceuticals.

“Securing our country’s critical supply chains is a bi-partisan effort we can all support,” said Perpetua Resources President and CEO Laurel Sayer. “President Biden’s Executive Order places critical minerals in the national spotlight, and antimony is a key mineral in three out of the four areas the President has directed federal officials to focus on over the next 100 days. We are encouraged by the recognition that responsible, domestic sourcing of minerals like antimony is essential to building resilient supply chains and a stronger, more sustainable, American future.”

Antimony strengthens alloys and makes them resistant to corrosion. Its properties make it a highly valuable mineral for many applications across a wide range of sectors. It is used in munitions for national defense, flame retardants, wind and hydro turbines, solar panels, large storage batteries, spaceships, cell phones, semiconductors, plastics and cable sheathing. Currently, there are no U.S. mined sources of antimony, China and Russia dominate the antimony supply with more than 80 percent of the world’s production. Perpetua Resource’s Stibnite Gold Project in Idaho could supply approximately thirty percent of the American demand for antimony in the first six years of production.

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

PERPETUA RESOURCES APPOINTS ENDEAVOUR FINANCIAL AS FINANCIAL ADVISOR

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (NASDAQ:PPTA / TSX:PPTA) (“Perpetua Resources” or the “Company”) announced today the appointment of Endeavour Financial (“Endeavour”) as its financial advisor to assist in the evaluation of funding options to support the development of the Company’s world class Stibnite Gold Project (“Project”), following the release of its Feasibility Study in December 2020.

Endeavour is a leading independent advisor dealing exclusively with the natural resources sector. It specializes in the junior to mid-tier market, providing advice on financing projects from multiple funding sources. The Endeavour team offers more than 160 years of mining finance experience and specializes in arranging multi-sourced funding structures for single asset development companies.

“We are pleased to announce the appointment of Endeavour Financial as our financial advisor for the arrangement of the project financing for the Stibnite Gold Project,” said Laurel Sayer, President and CEO of Perpetua Resources. “Endeavour is a well-regarded firm with a strong track record of success in the mining industry. Our vision is to provide the U.S. with a source of the critical mineral antimony, operate one of the highest-grade open pit gold mines in the country and restore and redevelop an abandoned brownfield site. This appointment is another important milestone as we look to move forward from permitting into development and restoration.”

George Pyper, Managing Director of Endeavour’s advisory business, commented: “Endeavour is delighted to be able to work with the Perpetua Resources team to evaluate and execute financing for the development of this world class asset.”

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

About Endeavour Financial:

Endeavour Financial is a private independent merchant banking company focused on providing expert and unbiased financial advisory services to the global natural resources sector. Endeavour Financial has a history of achieving success for clients based on resource industry focus, innovative transaction skills and the diverse professional backgrounds of its award-winning team. Offering advice in project, corporate and debt capital markets; equity-linked financings; mergers and acquisitions; and strategic business development over more than three decades, Endeavour Financial has established itself as a leading financial advisor in the natural resources sector. More information on Endeavour Financial and its services can be found at www.endeavourfinancial.com.

PERPETUA RESOURCES AND NEZ PERCE TRIBE AGREE TO STAY OF CLEAN WATER ACT LITIGATION

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (MAX:TSX / MDRPF:OTCQX) (“Perpetua Resources” or the “Company”) released the following statement regarding an agreement with the Nez Perce Tribe to stay the Tribe’s Clean Water Act lawsuit:

“The Nez Perce Tribe and Perpetua Resources (previously Midas Gold) have jointly moved for a 3-month stay of the Tribe’s Clean Water Act lawsuit while they pursue a Court-ordered dispute resolution process. The litigation stay will allow the parties to work with a neutral judge or mediator to determine if there are grounds to work out a resolution of the lawsuit.”

A copy of today’s filing can be found here.

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

MIDAS GOLD ANNOUNCES NAME CHANGE TO PERPETUA RESOURCES AND APPROVED NASDAQ LISTING

New Name Reinforces Commitment to Idaho

Restoration of Legacy Mining District and Domestic Production of Critical Mineral Antimony

Shares to Begin Trading on Nasdaq on February 18

Management Team Strengthened with Hiring of Jessica Largent and Promotion of Tanya Nelson

BOISE, ID – Perpetua Resources Corp. (formerly Midas Gold Corp.) (MAX:TSX / MDRPF:OTCQX,) (“Perpetua Resources” or the “Company”) announced today that it has changed its name to “Perpetua Resources Corp.” effective February 15, 2021 and the Company’s common shares have been approved for listing on the Nasdaq Stock Market (“Nasdaq”).

The Company’s common shares will begin trading on the Nasdaq on February 18, 2021 under the symbol “PPTA” and on the Toronto Stock Exchange (“TSX”) under the new name at market open on or around February 18, 2021 under the stock symbol “PPTA”. As the Stibnite Gold Project (the “Stibnite Project” or “Project”) continues to advance through major milestones, the listing on a U.S. stock exchange is a strategic decision to focus the Company’s business in the United States and open additional opportunities for American investment.

“Today’s approval to list on the Nasdaq points to our growth and readiness to enter the next chapter of bringing the Stibnite Gold Project vision to life,” said Laurel Sayer, President and CEO of Perpetua Resources. “The Nasdaq is a premier electronic exchange. Our listing here will allow us greater access to capital, which will help our team move the Stibnite Gold Project from permitting into production. We look forward to connecting with new investors, while delivering value to our long-term shareholders who have supported our vision for years.”

The new name “Perpetua Resources” is inspired by Idaho’s motto, Esto Perpetua, translated to mean “let it be perpetual”, and a reflection of the Company’s commitment to doing its part to protect the State of Idaho’s vast resources for generations to come. Midas Gold Idaho, Inc., the Company’s wholly owned subsidiary, has also updated its name to “Perpetua Resources Idaho, Inc.”

“We have always been more than a gold mining company, but you wouldn’t have known it by our name,” said Sayer. “The name Perpetua Resources better reflects our plan to restore an abandoned mining site, to responsibly develop the critical resources our country needs for a more secure and sustainable future and to be guided by a commitment to Idaho’s resources and people. We are proud to enter our next chapter with a name that helps communicate our values and the sustainable future we are working to create for all of us.”

The name change not only follows the Company’s recent announcement that it has relocated its corporate headquarters to Boise, Idaho, but the name also better aligns with the company’s vision and reflects the natural evolution in this next phase of project development. Recent accomplishments include the completion of a successful comment period for the Draft Environmental Impact Statement for the Stibnite Gold Project, release of a positive Feasibility Study, and an agreement finalized with regulators to help address legacy water contamination at the abandoned mining district that will enable the company to begin to restore the site.

The Stibnite Gold Project was designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national energy, defense, aerospace and technology sectors. Recent developments point to antimony playing an important role in renewable energy, including in wind turbines and solar panels, as well as emerging liquid metal batteries needed for large-scale energy storage in the green energy future. The Project is also one of the highest-grade gold deposits in the United States and would provide the resources necessary to fund the much-needed cleanup and restoration of the abandoned Stibnite Mining District. While the name is changing, the people, the project and the commitments made over the last ten years remain the same.

The Company introduced its new name with a video. It can be found here.

The Company has also updated its investor presentation and can be viewed here.

Idaho Team Growing

As Perpetua Resources moves its corporate headquarters to Idaho, it is also growing its team. Jessica Largent has joined the team as Vice President of Investor Relations and Finance. Ms. Largent has held finance leadership roles at Newmont, Turquoise Hill Resources and Rio Tinto and brings more than 15 years of mining industry experience in investor relations, planning, financial reporting and accounting to Perpetua Resources.

“This is a really exciting time for Perpetua Resources as we advance through the final permitting stages following a decade’s worth of study work and regulatory review. With a strong team, a critical minerals project and a commitment to mining responsibly, the company has all the right ingredients for long-term value creation,” said Largent.

Largent comes to Perpetua Resources after serving as the Vice President of Investor Relations for Newmont, a gold mining company with operations in North America, South America, Australia and Africa. Largent will be responsible for the strategy and leadership of the Company’s investor relations and finance efforts, drawing on her extensive relationships and years of finance experience.

The Company has also promoted long-time Idaho employee Tanya Nelson from Human Resources Manager and Corporate Secretary to the Midas Gold Idaho, Inc board to Vice President of Human Resources and Corporate Secretary of Perpetua Resources. Ms. Nelson has worked for the Company since 2012 and throughout that time has taken on more responsibility as the team has grown. Having more than 15 years of experience in accounting and human resources, Ms. Nelson is also an Idaho native and has lived in Valley County, where the Project is located, since 1998.

“I am passionate about working to provide job opportunities for rural Idaho and giving people the chance to come back home and start careers that will allow them to support their families,” said Nelson. “The people at Perpetua Resources are the strength of this Company and bring our corporate values to life through their actions. Our team cares about the Project but more importantly they care about Idaho, our neighbors and each other. I look forward to continuing to develop the talent that already exists on our team and recruiting the next generation of our workforce to help us bring our project from permitting to operations.”

About Perpetua Resources and the Stibnite Gold Project

Perpetua Resources Corp., through its wholly owned subsidiaries, is focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. In addition to the company’s commitments to transparency, accountability, environmental stewardship, safety and community engagement, Perpetua Resources adopted formal ESG commitments which can be found here.

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, next steps and courses of action including the expected dates on which trading is expected to commence on the Nasdaq and TSX; and the anticipated benefits of the Project and the Nasdaq listing. In certain cases, Forward-Looking Information can be identified by the use of words and phrases or variations of such words and phrases or statements such as “anticipates”, “complete”, “expected” “ensure”, and “potential”, in relation to certain actions, events or results “could”, “may”, “will”, “would”, be achieved. In preparing the Forward-Looking Information in this news release, Perpetua Resources has applied several material assumptions, including, but not limited to, assumptions that the current objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; that general business and economic conditions will not change in a materially adverse manner. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Perpetua Resources to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, changes in laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may result in unforeseen results in the permitting process; risks related to dependence on key personnel; risks related to unforeseen delays in the review process including availability of personnel from the United States Forest Service, State of Idaho and other stated, federal and local agencies and regulatory bodies (including, but not limited to, future US government shutdowns); risks related to opposition to the Project; risks related to the outcome of litigation and potential for delay of the Project, as well as those factors discussed in Perpetua Resources’ public disclosure record. Although Perpetua Resources has attempted to identify important factors that could affect Perpetua Resources and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Perpetua Resources does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

MIDAS GOLD FILES TECHNICAL REPORT FOR STIBNITE GOLD PROJECT FEASIBILITY STUDY ON SEDAR

BOISE, IDAHO – Midas Gold Corp. (MAX:TSX, MDRPF:OTCQX) today announced that it has filed an independent technical report on SEDAR in accordance with National Instrument 43-101 (“NI 43-101”) that details the results of the recent feasibility study on the company’s Stibnite Gold Project in Idaho (the “Technical Report”).

Minor changes were made to the economic model in the process of finalizing the Technical Report that resulted in slightly lower initial capital costs and similar overall economic indicators relative to the estimates included in the December 22, 2020 news release. The fundamental results of the economic analyses remain unchanged.

To view and download the Technical Report titled “Stibnite Gold Project Feasibility Study Technical Report” dated January 27, 2021, please visit www.sedar.com. The Technical Report will also be available on the Company’s website at www.midasgoldcorp.com.

Qualified Persons

The Technical Report was compiled by M3 Engineering & Technology Corp. (“M3”) under the direction of independent qualified persons (as defined under NI 43-101) (“QPs” or “Qualified Persons”) and in accordance with the requirements of NI 43-101. The QPs responsible for the Technical Report include: Richard Zimmerman, SME-RM (onsite and offsite infrastructure, cost estimating and financial modeling) and Art Ibrado, P.E. (mineral processing) with M3; Garth Kirkham, P.Geo. (mineral resources) with Kirkham Geosystems Ltd.; Christopher Martin, C.Eng. (metallurgy) with Blue Coast Metallurgy Ltd.; Grenvil Dunn, C.Eng. (hydrometallurgy) with Hydromet WA (Pty) Ltd.; Chris Roos, P.E. (mineral reserves) and Scott Rosenthal P.E. (mine planning) with Value Consulting, Inc.; and Peter Kowalewski, P.E. (tailings storage facility and closure) with Tierra Group International, Ltd.

The technical information in this news release has been reviewed and approved by Austin Zinsser, SME-RM, Sr. Resource Geologist for Midas Gold Idaho, Inc., and a Qualified Person.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project.

MIDAS GOLD COMPLETES SHARE CONSOLIDATION IN CONNECTION WITH NASDAQ LISTING APPLICATION

BOISE, IDAHO – Midas Gold Corp. (MAX:TSX, MDRPF:OTCQX) announces that the Company has consolidated its common shares on the basis of one (1) new post-consolidation common share for every ten (10) pre-consolidation common shares effective as of January 27, 2021 (the “Effective Date”) in connection with the Company’s previously announced application to list its common shares on the Nasdaq Stock Market. The share consolidation was necessary to meet the minimum share price requirements for trading on the Nasdaq.

“We are excited to announce the completion of our share consolidation today in connection with our application to list on the Nasdaq,” said Laurel Sayer, CEO of Midas Gold Corp. “We believe the Nasdaq listing will enable us to attract a broader range of shareholders, gain increased liquidity and deliver long-term value to investors.”

The Company’s common shares will continue to be traded on the TSX under the stock symbol “MAX” after the Effective Date. The common shares are scheduled to begin trading on a post-consolidation basis on or about January 29, 2021 under the new CUSIP/ISIN numbers 59562B507/CA59562B5071. A letter of transmittal will be mailed to all registered shareholders with instructions on how to exchange their existing share certificates for new share certificates. A copy of the letter of transmittal is also available on the Company’s profile on SEDAR and has also been posted on the Company’s website. Shareholders who hold their common shares through a securities broker, dealer, bank or other financial institution are not required to take any action with respect to the consolidation and should contact that intermediary for their post-consolidation positions.

For a period of 20 days following the completion of the Effective Date, the Company’s trading symbol on the OTCQX will temporarily be changed to MDRPD, following which it will automatically revert to MDRPF.

Following the consolidation, the Company has a total of 47,522,706 common shares issued and outstanding. The exercise price or conversion price, as applicable, of the Company’s common shares issuable pursuant to outstanding stock options, warrants and convertible notes will be proportionately adjusted. No fractional common shares will be issued; all fraction shares equal to or greater than one-half resulting from the consolidation will be rounded to the next whole number. Otherwise, such fractional share will be cancelled.

Frequently Asked Questions (FAQ) regarding the consolidation may be found here https://midasgoldidaho.com/news/consolidation or, for further information about Midas Gold Corp., please contact:

(e): info@midasgoldcorp.com

Facebook: www.facebook.com/midasgoldidahoTwitter: @MidasIdaho

Website: www.midasgoldcorp.com

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project.

MIDAS GOLD REACHES AGREEMENT TO BEGIN ENVIRONMENTAL RESTORATION AT ABANDONED MINE SITE AND ANNOUNCES RELOCATION TO UNITED STATES

Agreement Signed with Federal Agencies to Improve Water Quality at Stibnite

Midas Gold Moves Headquarters to Idaho and Intends to Redomicile to United States

Nasdaq Listing Application Submitted and Related Share Consolidation Approved

VANCOUVER, BRITISH COLUMBIA – Midas Gold Corp. (MAX:TSX / MDRPF:OTCQX, “Midas Gold” or the “Company”) today announced, after three years of extensive discussions, federal agencies have authorized and directed the Company to perform agreed immediate clean up actions to address contaminated legacy conditions within Idaho’s abandoned Stibnite mining district that are negatively impacting water quality. While Midas Gold did not cause the legacy environmental problems at Stibnite, the recently signed agreement points to the need for timely environmental action and is a testament to the Company’s willingness to take part in environmental restoration. The Agreement (as defined below) is necessary to allow the Company to voluntarily address environmental conditions at the abandoned mine site without inheriting the liability of the conditions left behind by past operators. As such, the Company may now provide the early clean up actions deemed necessary by the federal government to improve water quality. Should the Stibnite Gold Project (“Project”) move forward with proposed mining and restoration activities, this Agreement will also allow for comprehensive site cleanup by directing the Company to address legacy features including millions of tons of legacy mine tailings that fall outside of the Project footprint and would otherwise not be addressed. With the Agreement in place, Midas Gold is now moving forward with plans to relocate its corporate headquarters from British Columbia, Canada to Boise, Idaho and intends to redomicile the Company to the United States. Midas Gold has also approved a share consolidation in connection with a planned U.S. listing on the Nasdaq Stock Market (“Nasdaq”).

Agreement Reached to Address Legacy Water Quality

Through an Administrative Settlement Agreement and Order on Consent (“ASAOC” or the “Agreement”) signed on January 15, 2021 by the Environmental Protection Agency (“EPA”) and U.S. Forest Service, with concurrence by the U.S. Department of Justice, Midas Gold has been instructed to clean up certain contaminated conditions within the Stibnite mining district in Idaho. The sources of contamination to be addressed by the Agreement are decades old and largely stem from tungsten and antimony mining during World War II and the Korean War, long before Midas Gold started planning for redevelopment of the site.

The cleanup Agreement was entered into under the Comprehensive Environmental Response, Compensation and Liability Act (“CERCLA”) and is the result of almost three years of discussion with the Environmental Protection Agency (EPA). The EPA also lead discussions with U.S. Department of Justice, U.S. Forest Service, State of Idaho and two Idaho tribes. Before finalizing the agreement, the EPA also conducted government-to-government consultation with the Shoshone-Bannock Tribes and Nez Perce Tribe.

“For decades, ground and surface water at Stibnite have suffered from elevated levels of arsenic and antimony,” said Laurel Sayer, CEO of Midas Gold Corp. and Midas Gold Idaho. “Yet, because the problems stem from historic mining activity, there are no responsible parties left to address the issues at hand. While we did not cause the problems impacting water quality today, we have always been clear on our intentions to be a part of the solution. We know redevelopment of the Stibnite Mining District for mining activity must include restoration of legacy features. So, when we saw the need to address sources of water contamination more quickly at Stibnite, we knew we had to offer our help.”

Importantly, the Agreement does not change the permitting process or anticipated permitting schedule for the Stibnite Gold Project through the National Environmental Policy Act (“NEPA”), nor does it alter any potential CERCLA liability or CERLCA defenses for Midas Gold or federal entities should the Stibnite Gold Project be fully permitted and move into operations. The Agreement only allows for specified EPA directed cleanup actions to occur.

“Today’s agreement develops a clear pathway for comprehensive cleanup activity at a long abandoned mine site and marks an important opportunity for meaningful water quality improvement at Stibnite,” said John C. Cruden, outside counsel for Midas Gold and former Assistant Attorney General for the Environment and Natural Resources Division in the Department of Justice in President Obama’s Administration.

The Agreement comes with a determination by federal regulators that due to historical activity, site conditions presently constitute an “actual or threatened release of hazardous substances” and that time critical removal actions are necessary to protect human health and welfare and the environment. In order to provide investment and cleanup the legacy environmental hazards and waste left behind at Stibnite, Midas Gold reached an agreement with federal agencies under CERCLA to define the cleanup work the Company will conduct and to clarify how to protect the Company from inheriting the environmental liability of past actors who abandoned the site. This situation is not unique to Midas Gold but one that has stalled cleanup work at abandoned mine sites across the country. This Agreement may well provide an example for cleaning up abandoned mining sites elsewhere in the nation.

“Water quality in the Stibnite Mining District has been a known problem for decades. As the closest community to the site, I can tell you that cleanup is long overdue,” said Willie Sullivan, Yellow Pine Resident and board member of the Yellow Pine Water Users Association. “This agreement between the EPA and Midas Gold is the first meaningful step toward real improvements in water quality conditions for the East Fork South Fork Salmon River and downstream communities like Yellow Pine. We have seen Midas Gold’s commitment to doing business the right way and their willingness to help with clean up now tells me they are the right partner for this effort.”

The ASAOC consists of three primary phases. The first phase of the Agreement is designed to significantly improve water quality over the next four years. It includes several CERCLA “time critical removal actions” consisting of water diversion projects designed to move water so it may avoid contaminated areas of the site, and removal of over at least 325,000 tons of historical mine waste from problematic locations that are currently affecting water quality. In addition, Midas Gold has agreed to conduct a full biological assessment, Clean Water Act evaluation, and a cultural resource survey. To ensure all that important work will be done, Midas Gold is providing US$7.5 million in financial assurance for Phase 1 projects.

Phases 2 and 3 of the ASAOC would move forward if the Stibnite Gold Project receives permission to proceed with mining under the National Environmental Policy Act (“NEPA”) and would provide the opportunity for comprehensive and site-wide cleanup of legacy features and waste by including permission to address legacy areas that are not included in the restoration activities proposed by the Stibnite Gold Project.

“As Idahoans, we care deeply about our home state and we are committed to partnerships that improve our water and lands,” said Sayer. “Our vision for Stibnite has always been that responsible industry could be a part of the solution to improve water quality and habitat at the long-abandoned site. Along with the desire and resources to help, we have needed permission to act. This Agreement provides the green light to finally see improvements in Idaho’s water quality at Stibnite and is one more opportunity for us to put our commitment to restoring the site into action.”

To read more on this Agreement additional information may be found here: www.MidasGoldIdaho.com/news/asaoc/

Idaho Headquarters & Redomicile

In conjunction with the signing of the Agreement, Midas Gold is relocating its corporate head office from Vancouver, Canada to Boise, Idaho, effective January 31, 2021. Additionally, Midas Gold has formally engaged legal and tax advisers to explore the feasibility of redomiciling to the United States. The intention to redomicile, which will be subject to determining an acceptable transaction structure, is in line with Midas Gold’s stated strategy of becoming a U.S.-based producer of critical minerals committed to the restoration and redevelopment of the Stibnite Gold Project. Midas Gold will provide updates on this process as necessary going forward.

“Idaho is our home,” said Sayer. “Our Project, our people and our work are focused here in Idaho and the move reconfirms our commitment to seeing the Project come to fruition.”

Share Consolidation and Nasdaq Listing

In conjunction with the relocation of its head office and its goal of becoming a U.S.-based producer of critical minerals, Midas Gold has submitted an application to list its common shares on the Nasdaq, and the listing of the common shares will be subject to fulfilling Nasdaq’s initial listing conditions. In order to meet Nasdaq minimum share trading price, Midas Gold’s Board of Directors also approved a 10-for-1 share consolidation, which is a necessary condition for the Company to meet Nasdaq’s listing conditions. Completion of the consolidation is subject to Toronto Stock Exchange approval and the timing will be governed by applicable regulatory and transfer agent requirements.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, site restoration and redevelopment of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by the Stibnite Gold Project.

Forward-Looking Information