Press Releases

MIDAS GOLD ANNUAL GENERAL MEETING - WEDNESDAY, MAY 13TH AT 10:00AM

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) (“Midas Gold” or the “Company”) is pleased to announce that its Annual General Meeting of shareholders will be held at 10:00am PT this Wednesday, May 13th, 2015 in the Vancouver Room of the Metropolitan Hotel, 645 Howe Street, Vancouver, BC.

All of the directors of Midas Gold Corp. as well as the independent directors of Midas Gold Idaho, Inc., Midas Gold Corp.’s operating subsidiary in Idaho, will be attending the meeting. Following the formal business of the meeting, Stephen Quin, Midas Gold’s President and CEO will be giving a brief presentation to update the Company’s shareholders on current and future activities.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, development of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by its Stibnite Gold Project.

MIDAS GOLD ANNOUNCES FINANCINGS TO RAISE UP TO C$8 MILLION

Not for distribution to United States newswire services or for dissemination in the United States

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) (“Midas Gold” or the “Company”) is pleased to announce that it has entered into an agreement with Haywood Securities Inc., on behalf of a syndicate of agents (the “Agents”), under which the Agents have agreed to sell up to 12,000,000 units of the Company (“Units”) at a price of C$0.42 per Unit on a best-efforts private placement basis, representing gross proceeds to the Company of up to C$5,040,000 (the “Brokered Financing”). The Company may concurrently complete a non-brokered private placement (the “Non-Brokered Financing” and together with the Brokered Financing, the “Financings”) on the same terms as the Brokered Financing to raise up to an additional C$3,000,000 for aggregate gross proceeds to the Company of up to C$8,040,000. Certain Directors and employees of Midas Gold plan to participate in the Non-Brokered Financing.

In addition, the Agents have been granted an over-allotment option to sell up to an additional C$1,000,000 of Units on the same terms as the Financings.

Each Unit will consist of one common share of the Company and one-half of one common share purchase warrant (each whole common share purchase warrant, a “Warrant”). Each Warrant will entitle the holder to purchase one additional common share of the Company at an exercise price of C$0.60 for a period of 24 months following the closing of the Financings.

The Company intends to use the net proceeds of the Financings to fund the continued advancement of the Company’s Stibnite Gold Project, and for working capital and general corporate purposes.

Closing of the Financings is expected to be on or about May 20, 2015 and is subject to certain conditions, including but not limited to, the receipt of all necessary approvals, including the approval of the TSX, and other securities regulatory authorities as applicable.

This news release does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), or any state securities laws, and may not be offered or sold within the United States or to, or for the account or benefit of, “U.S. persons,” as such term is defined in Regulation S under the U.S. Securities Act, unless an exemption from such registration is available.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, development of gold-antimony-silver deposits in the Stibnite-Yellow Pine district of central Idaho that are encompassed by its Stibnite Gold Project.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; and the plans for completion of the Financings, expected use of proceeds and business objectives. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “anticipates”, “expects”, “understanding”, “has agreed to” or variations of such words and phrases or statements that certain actions, events or results “would”, “occur” or “be achieved”. Although Midas Gold has attempted to identify important factors that could affect Midas Gold and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended, including, without limitation, the risks and uncertainties related to the Financings not being completed in the event that the conditions precedent thereto are not satisfied; uncertainties related to raising sufficient financing in a timely manner and on acceptable terms. In making the forward-looking statements in this news release, Midas Gold has applied several material assumptions, including the assumptions that (1) the conditions precedent to completion of the Financings will be fulfilled so as to permit the Financings to be completed in or about May of 2015; (2) all necessary approvals and consents in respect of the Financings will be obtained in a timely manner and on acceptable terms; and (3) general business and economic conditions will not change in a materially adverse manner. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Midas Gold does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

MIDAS GOLD REPORTS THAT VISTA GOLD HAS REDUCED ITS SHAREHOLDINGS TO 5.5%

Vista Gold enters into a six month Lock-up Agreement for its remaining Midas Gold Shares

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) reports that it has been notified by Vista Gold Corp. (“Vista”) that Vista has completed the sale of 8.0 million shares of Midas Gold Corp. (“Midas Gold”) held by Vista and/or its subsidiaries to certain arm’s-length parties at a price of C$0.46 per share. This transaction has reduced Vista’s shareholdings in Midas Gold from 15,802,615 shares (representing 11.2% of Midas Gold’s currently issued shares) to 7,802,615 shares (representing 5.5% of Midas Gold’s currently issued shares). As a result of this sale and the consequential change of ownership, Vista is no longer a reporting insider of Midas Gold. Midas Gold understands that all of the 8.0 million shares were fully placed with institutional and other investors on February 25, 2015, with settlement occurring on March 13, 2015. As a condition of the sale of the shares, Midas Gold understands that Vista has agreed not to sell any of its remaining shares in Midas Gold for a period of six months from closing.

“We are pleased to see eight million shares previously owned by Vista Gold placed more broadly,” said Stephen Quin, President & CEO of Midas Gold. “We appreciate the vote of confidence from our new shareholders and look forward to continuing to advance the exploration and evaluation of our Stibnite Gold Project.”

Midas Gold currently has 141,705,090 shares issued and outstanding; the completion of this transaction does not affect the number of shares issued and outstanding.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries, is focused on the exploration and, if warranted, development of gold-antimony-silver deposits in the Stibnite‐Yellow Pine district of central Idaho that are encompassed by its Stibnite Gold Project.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “anticipates”, “expects”, “understands”, “has agreed to” or variations of such words and phrases or statements that certain actions, events or results “would”, “occur” or “be achieved”. Although Midas Gold has attempted to identify important factors that could affect Midas Gold and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. In making the forward-looking statements in this news release, Midas has applied several material assumptions, including the assumption that Vista will comply with its obligation not to sell its remaining shares in Midas Gold for a period of 6 months. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Midas Gold does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

MIDAS GOLD FILES TECHNICAL REPORT FOR STIBNITE GOLD PROJECT PRELIMINARY FEASIBILITY STUDY ON SEDAR

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (MAX:TSX, MDRPF:OTCQX) Further to yesterday’s news release, the Company today announced that it has filed an independent Technical Report on SEDAR detailing the results of the recent Preliminary Feasibility Study on its Stibnite Gold Project in Idaho.

To view and download the report, please visit www.sedar.com. The report will also be available on the Company’s website at www.midasgoldcorp.com.

About Midas Gold and the Stibnite Gold Project

Midas Gold Corp., through its wholly owned subsidiaries Midas Gold, Inc. and Idaho Gold Resources, LLC, is focused on the exploration and, if warranted, development of deposits in the Stibnite-Yellow Pine district of central Idaho. The principal gold deposits identified to date within the Project are the Hangar Flats, West End and Yellow Pine deposits, all of which are associated with important structural corridors, as well as a mineral resource contained in historic tailings.

MIDAS GOLD COMPLETES POSITIVE PRELIMINARY FEASIBILITY STUDY FOR STIBNITE GOLD PROJECT, IDAHO

Redevelopment offers Potential for Restoration of Brownfields Site with Significant Economic Benefits

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (MAX:TSX / OTCQX:MDRPF) today announced the results of an independent Preliminary Feasibility Study and technical report (the “PFS”) completed on its Stibnite Gold Project (the “Project”) in Idaho. Redevelopment of the Project has the potential to clean up an existing brownfields site and create one of the largest gold producers in the United States. This billion-dollar mining Project could create, directly and indirectly, more than 700 jobs in Idaho during the first three years while under construction and nearly 1,000 jobs in Idaho during 12 years of Project operations, while generating significant tax and other benefits to the local, state and federal economies.

Project Design Principles

The PFS defines an economically feasible, technically and environmentally sound Project that minimizes impacts and maximizes benefits. Given the extensive history of mining that has resulted in considerable disturbance and environmental impact at the Project site, key considerations that provided a foundation for the evaluation of alternatives considered for components of the Project are:

The Project design began with the end in mind, contemplating the development, operation and closure of the Project on a sustainable basis, meeting society’s present day needs for economic prosperity while remaining protective of the environment, as well as enhancing the ability of future generations to sustain their own needs.

The Project is designed to ensure ongoing positive social and economic benefits through taxation, employment, and business opportunities in a region where the economy has suffered for more than a decade, and has led to some of the highest unemployment and lowest wages in Idaho.

From the beginning, the Project has been designed for what will remain after closure. The plan for closure is protective of the environment and incorporates inherently stable, secure features that will provide the foundation for a naturally sustainable ecosystem.

Considerable clean-up and repair of existing mining-related impacts would begin in parallel with construction and would continue through the operating life.

The new facilities contemplated for the Project are tightly constrained and are located in historically impacted areas, minimizing the incremental Project footprint.

Salmon and other fishery enhancements are integral to the Project design, including removal of man-made barriers and reconstruction of natural habitat to allow salmon and other fish migration into the upper reaches of the watershed for the first time since 1938.

All aspects of the Project are designed to improve existing conditions and remain protective of the environment, with the extensive costs related to remediation and reclamation of historical impacts accommodated by an economically feasible Project.

Midas Gold intends to actively engage with interested parties to evaluate potential options identified in the PFS for development of a large scale, long life mining operation integrated with restoration of this extensively impacted brownfield site.

PFS Highlights

The PFS provides a comprehensive overview of the Project and includes recommendations for future work programs required to advance the Project to a decision point. The PFS contemplates the development of one of the highest grade open pit gold mines in the US that, once in production, would rank among the largest gold producers in the country, with industry competitive cash and all-in sustaining costs. All amounts discussed in this news release are in US$ and all units are US unless otherwise stated.

Table 1: Stibnite Gold Project - Preliminary Feasibility Study Highlights (1)

(Base Case, at $1,350/oz of gold)

| Component | Years 1-4 | Life-Of-Mine (12 years) | ||

|---|---|---|---|---|

| Annual Average | Total | Annual Average | Total | |

| Recovered Gold (000s oz) | 388 | 1,551 | 337 | 4,040 |

| Recovered Antimony (M lbs) | 14 | 56 | 8.3 | 99.9 |

| Cash Costs ($/oz)(2) (Net of by-product credits) | 483 | 568 | ||

| All-in Sustaining Costs (2) (Net of by-product credits) | 526 | 616 | ||

| Initial Capital ($M) including 17.2% contingency | 970 | |||

| Pre-tax NPV5% ($M) (3) | 1,093 | |||

| After-tax NPV5% ($M) (3) | 832 | |||

| Pre-tax/After-tax IRR (4) in % | 22.0/19.3 | |||

| Pre-tax/After-tax Payback period in Years | 3.2/3.4 | |||

| Notes: (1) In this release, “M” = million, all amounts in US$. (2) See non-International Financial Reporting Standards (“IFRS”) measures below. (3) NPV5% = Net present value at a 5% discount rate. (4) IRR = internal rate of return. | ||||

The key similarities and differences between the PFS and the Preliminary Economic Assessment (“PEA”) completed in 2012 are:

The Project is similar in throughput and concept to that in the PEA, but with additional environmental improvements that result in a reduced footprint, increased remediation of historical mining impacts and a more sustainable outcome.

Clean-up of significant historical impacts and new development activities are now concentrated in areas already disturbed by prior operators.

Environmentally protective risk reduction strategies and a comprehensive closure plan that incorporates restoration of the local fishery, extensive stream channel remediation and large scale wetland development are integral to the Project.

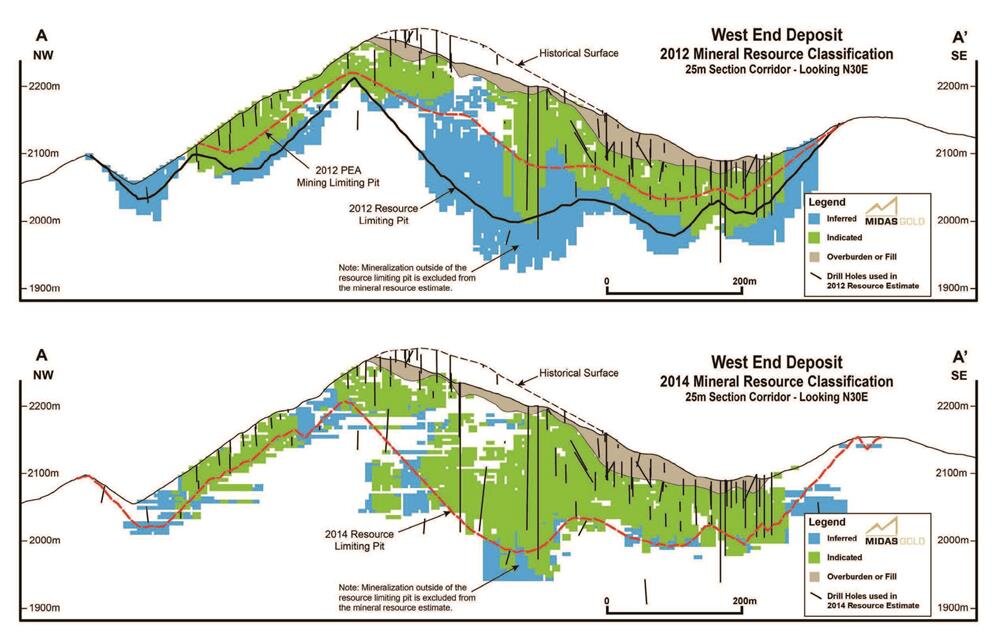

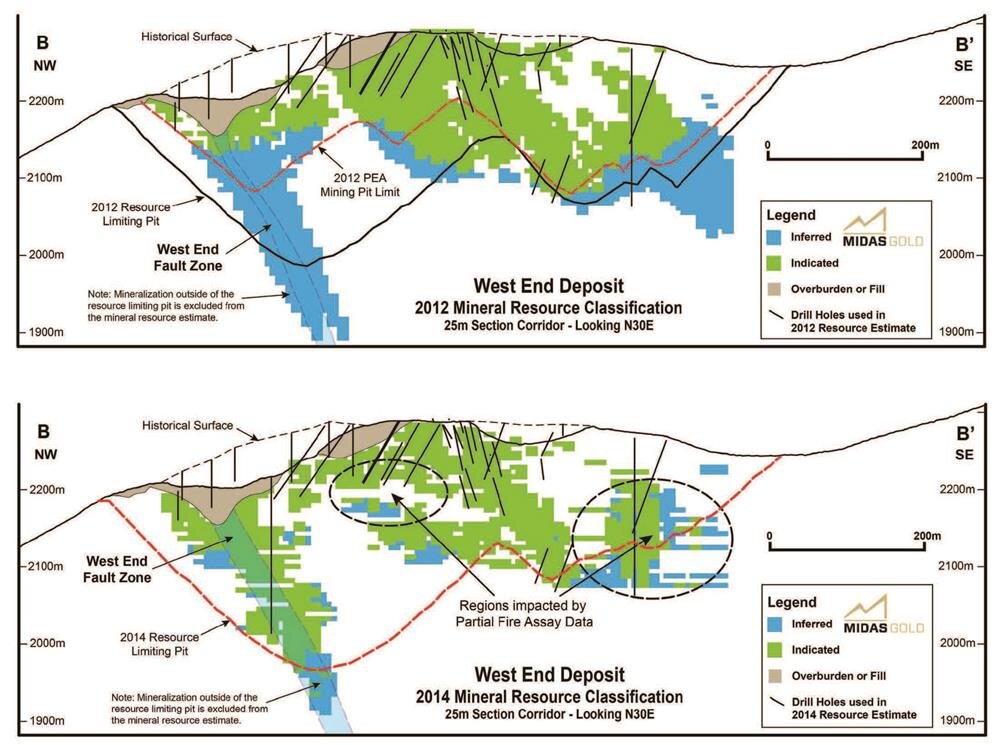

Lower life-of-mine (“LOM”) revenues versus the PEA. The principal reasons for lower revenue are lower assumed metal prices and less recovered metal within the economic pit limits. Reasons for the reduction in recovered metal are:

Exclusion of inferred mineral resources from the mine plan, as is required in a PFS (successful conversion of which to mineral reserves would increase the recovered metal - see “Opportunities” below);

Exclusion or restriction of the use of certain historical data primarily in the higher grade upper portions of the Yellow Pine deposit, for which additional drilling is recommended (additional drilling may increase grades and the recovered metal in this area - see “Opportunities” below);

Portions of the West End deposit with only cyanide assays in transitional and sulfide gold were estimated with more conservative assumptions (additional drilling may increase grades and recovered metal in these areas - see “Opportunities” below); and

Elimination of a relatively low margin, high strip ratio portion of the Hangar Flats deposit, the elimination of which substantially reduces the quantity of waste rock generated and reduces the Project footprint.

Initial capital costs have increased as a result of the decision to sustain high levels of gold production in the early years by removing bottlenecks in the plant, but these increases are more than offset on a life-of-mine basis primarily through the elimination of the high strip pushback at Hangar Flats, leasing of major mining equipment and reductions in contingency, resulting in an overall reduction in the life-of-mine capital as compared to the PEA.

Overall per ton operating costs increased versus the PEA as result of a number of factors including leasing of the major mining equipment, finer grinding, lower by-product credits and addition of a 1.7% Net Smelter Return (“NSR”) royalty; the increases are partially offset by lower G&A costs.

“This preliminary feasibility study confirms potential for a long life, low cost mining operation at the Stibnite Gold Project that could provide significant local benefits and address much of the historical environmental impacts created by prior activities at this brownfield site,” said Stephen Quin, President and CEO of Midas Gold Corp. “Completion of this preliminary feasibility study provides an opportunity to engage interested parties in discussions about the improvements made to the Project design over the past two years,” he said. “In addition, the Stibnite Gold Project presents a tremendous opportunity to create hundreds of long term, well paid jobs in a part of Idaho that really needs them, to generate a substantial stream of revenue to county, state and federal governments, to clean up major portions of this heavily disturbed site, and to improve the environmental sustainability of the area,” he said. “We look forward to continuing constructive discussions with interested parties to explain how we have worked to address their areas of interest and concern and to consider any additional input they might have.”

Conference Call and Webcast

Midas Gold will be hosting a conference call and webcast to discuss highlights of the PFS at 11 AM PST (2:00 PM EST) on December 15, 2014. Details are provided toward the end of this news release.

Preliminary Feasibility Study

The PFS was compiled by M3 Engineering & Technology Corp. (“M3”) which was engaged by Midas Gold Corp.’s wholly owned subsidiary, Midas Gold, Inc. (“MGI”), to evaluate potential options for the possible redevelopment of the Stibnite Gold Project based on information available up to the date of the PFS. Givens Pursley LLP (land tenure), Kirkham Geosystems Ltd. (mineral resources), Blue Coast Metallurgy Ltd. (metallurgy), Pieterse Consulting, Inc. (autoclave), Independent Mining Consultants Inc. (mine plan and mineral reserves), Allen R. Anderson Metallurgical Engineer Inc. (recovery methods), HDR Engineering Inc. (access road), SPF Water Engineering, LLC (water rights) and Tierra Group International Ltd. (tailings, water management infrastructure and closure) also contributed to the PFS. Additional details of responsibilities are provided at the end of this news release and in the technical report to be filed on SEDAR by the end of 2014. The PFS supersedes and replaces the technical report entitled “Preliminary Economic Assessment Technical Report for the Golden Meadows Project, Idaho” prepared by SRK Consulting (Canada) Inc. and dated September 21, 2012 and that report should no longer be relied upon.

For readers to fully understand the information in this news release, they should read the PFS technical report (to be available on SEDAR or at www.midasgoldcorp.com by the end of 2014) in its entirety, including all qualifications, assumptions and exclusions that relate to the information set out in the technical report which qualifies the technical information contained in the technical report. The technical report is intended to be read as a whole, and sections should not be read or relied upon out of context. The technical information in the technical report is subject to the assumptions and qualifications contained in the Technical Report.

Project Concept

The Project design concepts reflect the extensively disturbed nature of the current site, which has been explored and mined for the past 100 years. Clean-up of legacy environmental issues, improvement of water quality, minimizing incremental mining-related disturbance, and protection and re-establishment of the upstream fishery, both during operations and following mine closure, were incorporated.

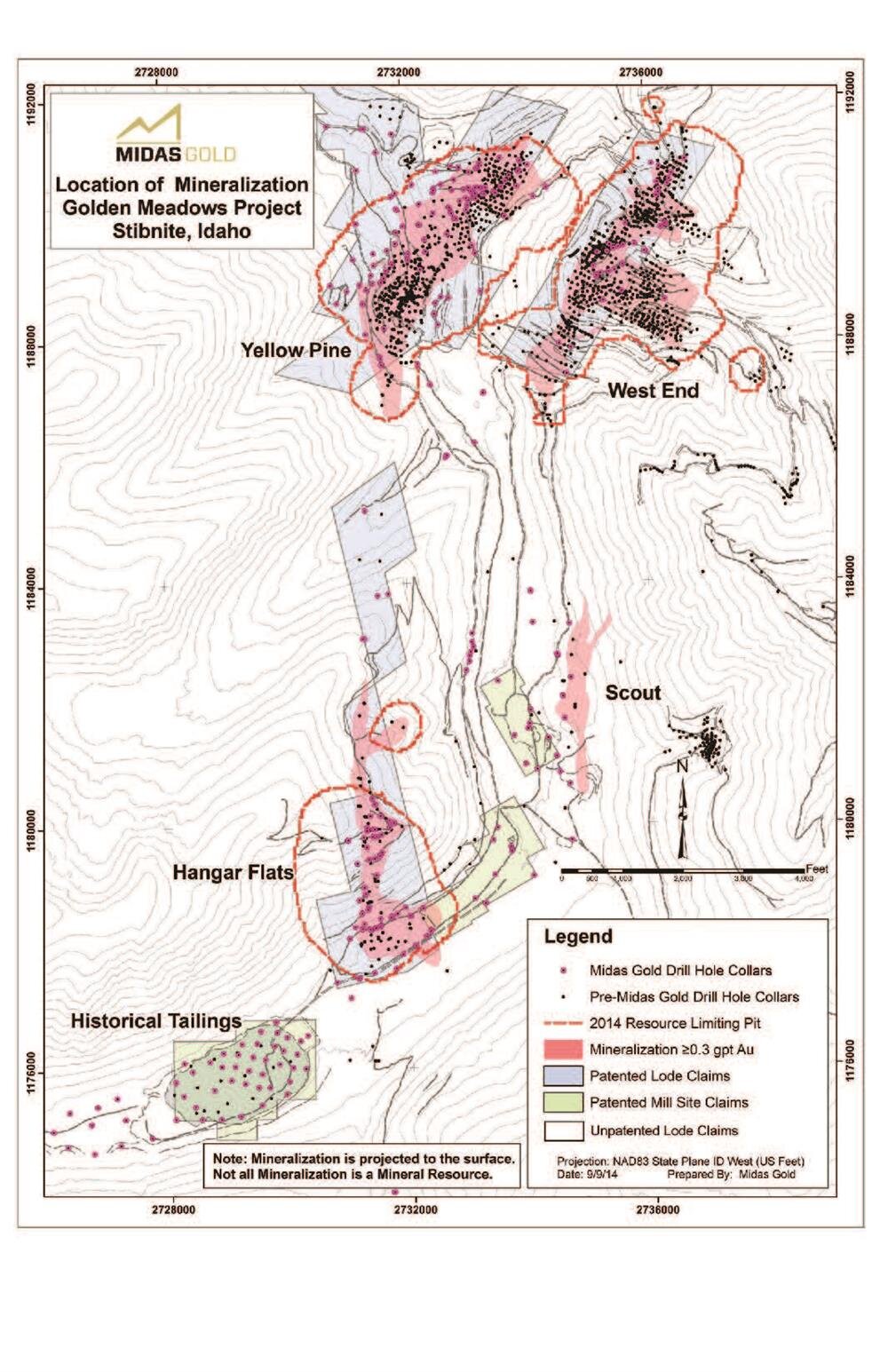

The Project consists of the Yellow Pine, Hangar Flats and West End in situ gold deposits; onsite historic tailings that contain anomalous gold also form part of the Project. The Yellow Pine and Hangar Flats deposits contain zones of antimony and silver mineralization, and all deposits are located in areas of significant historic mining activity. Conventional open pit methods are recommended for mining the deposits, while the historic tailings would be reclaimed and reprocessed. All of these deposits are located within three kilometres of each other. The deposits primarily comprise sulfide mineralization, while the West End deposit contains some oxide and transitional mineralization. A single plant has been designed that can process all types of mineralization. Sulfide mineralization would be crushed, milled and treated with sequential flotation to produce two products: (1) an antimony concentrate (when there is sufficient antimony grade) for off-site shipment to a third party smelter and (2) for all sulfide material, a gold concentrate that would be further processed on site using pressure oxidation (“POX”) followed by agitated tank leaching to produce gold-silver doré. The minor amounts of oxide material are amenable to milling and then agitated tank leaching to recover gold and silver.

Production is assumed to be a nominal 22,050 short tons per day (“st/d”) or 8.05 million short tons (“Mst”) per year of mill feed. With this production rate, the mine life would be approximately 12 years, with approximately 98.1 Mst of material processed. The mine would have an overall strip ratio of 3.5 tons of waste rock per ton of ore. Gold accounts for approximately 94% of the value of the payable metals, antimony accounts for about 5% of the payable value and silver less than 1%.

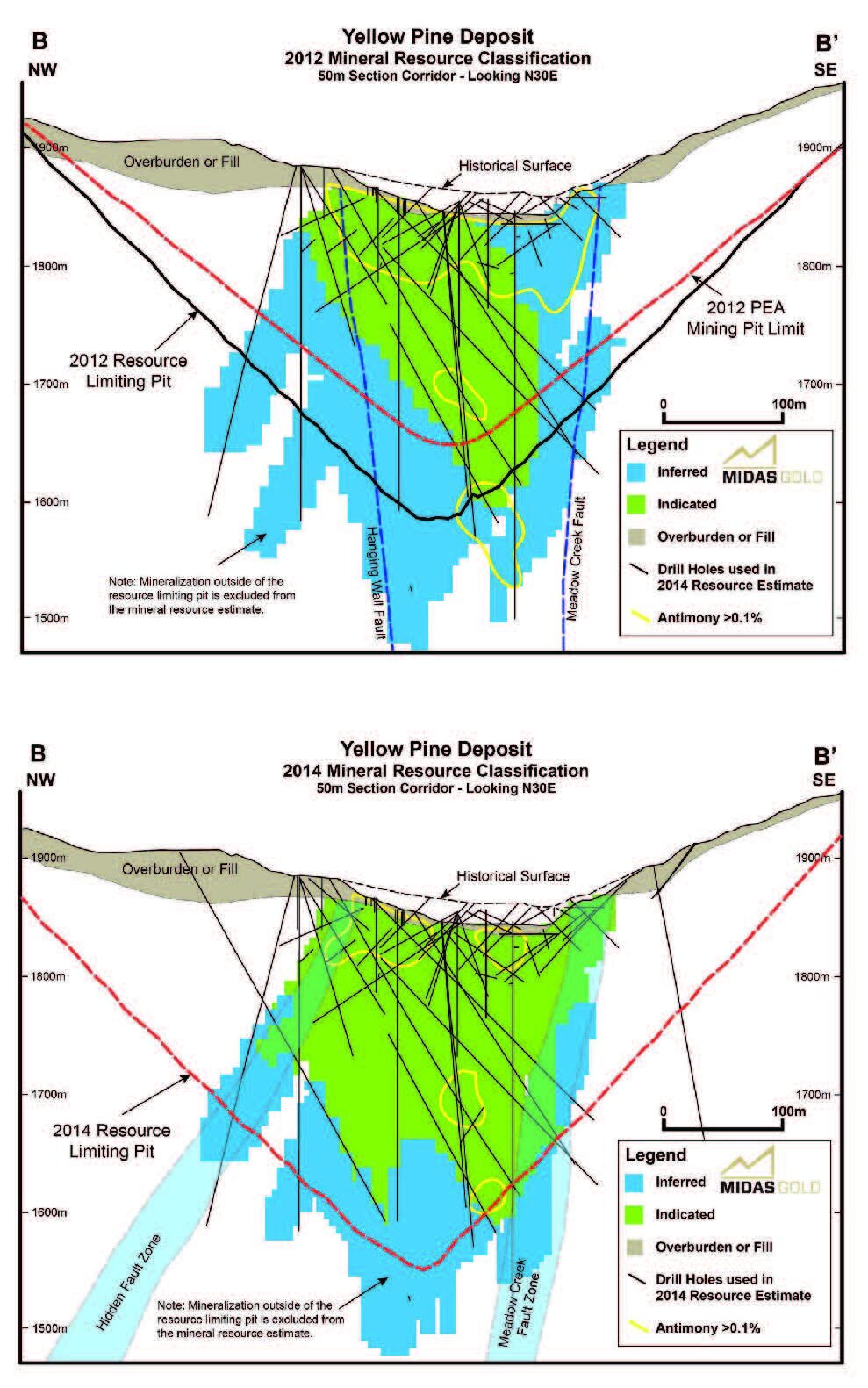

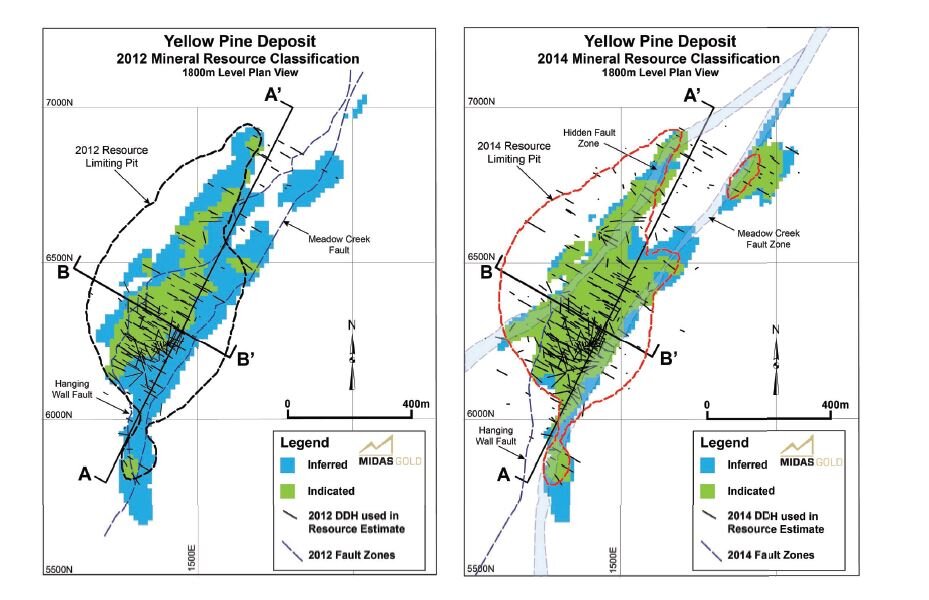

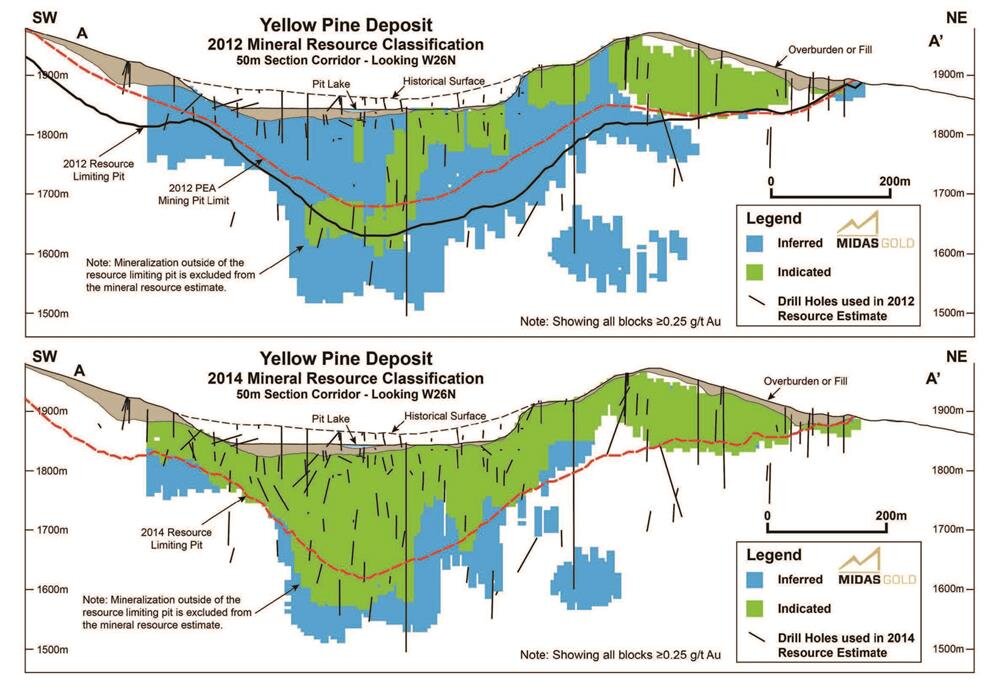

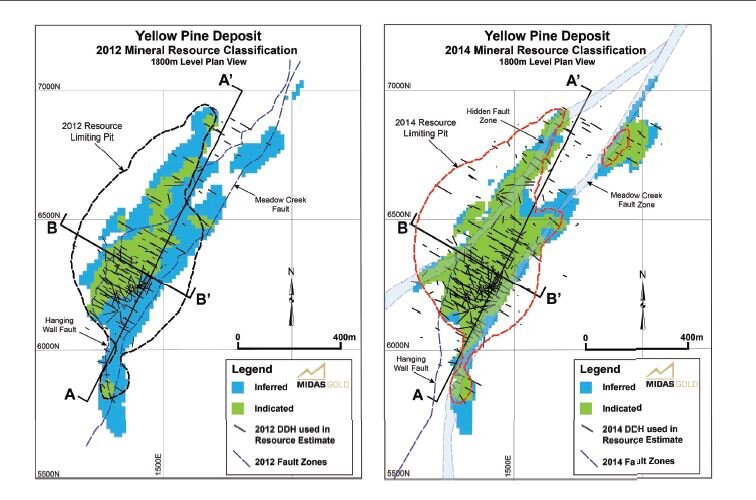

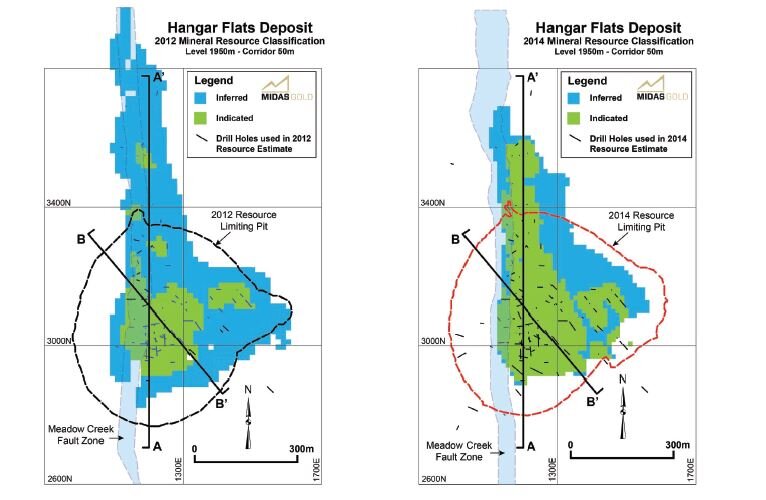

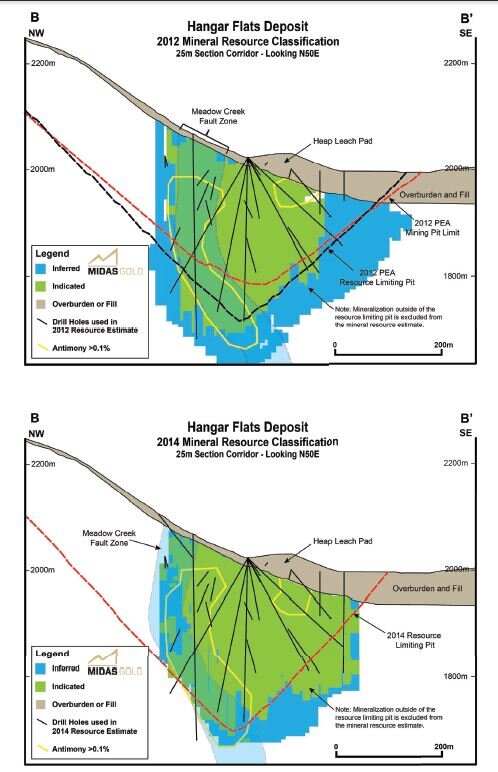

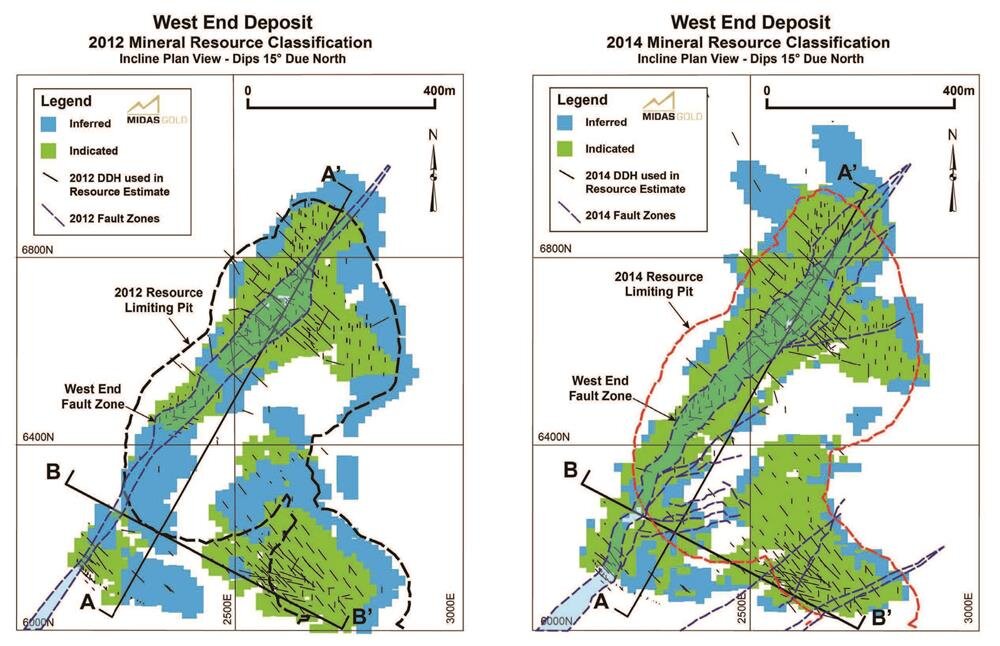

Mineral Resources

The mineral resource estimates, previously announced in Midas Gold’s news release dated September 10, 2014, for Yellow Pine, Hangar Flats, West End and the historic tailings were prepared to industry standards and best practices using commercial mine-modeling and geostatistical software by third party consultants and verified by an Independent qualified person, Garth Kirkham of Kirkham Geosystems. Mr. Kirkham confirmed that the data used in the estimation is suitable for use in the reported mineral resource and mineral reserve estimates.

The mineral resources were initially calculated using a gold price of $1,400/oz and parameters defined in the PFS; based on this, the open pit sulfide cut-off grade was calculated as approximately 0.55 g/t Au and the open pit oxide cut-off grade calculated as approximately 0.35 g/t Au. However, Midas Gold elected to report its mineral resources at a 0.75 g/t Au sulfide cut-off grade and 0.45 g/t Au oxide cut-off grade, which is equivalent to utilizing the cost assumptions stated in the PFS and a gold selling price of approximately $1,000/oz for sulfides and $1,100/oz for oxides.

Table 2: Stibnite Gold Project - Consolidated Mineral Resource Statement

| Classification / Deposit | Metric Tonnes (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|

| Indicated: | |||||||

| Hangar Flats | 21,389 | 1.60 | 1,103 | 4.30 | 2,960 | 0.11 | 54,180 |

| West End | 35,974 | 1.30 | 1,501 | 1.35 | 1,567 | 0.01 | 6,563 |

| Yellow Pine | 44,559 | 1.93 | 2,762 | 2.89 | 4,133 | 0.09 | 84,777 |

| Historic Tailings | 2,583 | 1.19 | 99 | 2.95 | 245 | 0.17 | 9,648 |

| Total Indicated | 104,506 | 1.63 | 5,464 | 2.65 | 8,904 | 0.07 | 155,169 |

| Inferred: | |||||||

| Hangar Flats | 7,451 | 1.52 | 363 | 4.61 | 1,105 | 0.11 | 18,727 |

| West End | 8,546 | 1.15 | 317 | 0.68 | 187 | 0.01 | 1,083 |

| Yellow Pine | 9,031 | 1.31 | 380 | 1.50 | 437 | 0.03 | 5,535 |

| Historic Tailings | 140 | 1.23 | 6 | 2.88 | 13 | 0.18 | 563 |

| Total Inferred | 25,168 | 1.32 | 1,066 | 2.15 | 1,743 | 0.05 | 25,908 |

Notes:

| |||||||

The Yellow Pine and Hangar Flats deposits contain zones with substantially elevated antimony-silver mineralization, defined as containing greater than 0.1% antimony, relative to the overall mineral resource. The historic tailings mineral resource also contains elevated concentrations of antimony. These higher grade antimony zones are reported separately in Table 3 below. Antimony zones are reported only if they lie within gold mineral resource estimates.

Table 3: Stibnite Gold Project - Antimony Sub-Domains within the Consolidated Mineral Resources

| Classification | Metric Tonnes (000s) | Gold Grade (g/t) | Contained Gold (000s oz) | Silver Grade (g/t) | Contained Silver (000s oz) | Antimony Grade (%) | Contained Antimony (000s lbs) |

|---|---|---|---|---|---|---|---|

| Indicated | 12,564 | 1.98 | 800 | 6.23 | 2,518 | 0.50 | 138,218 |

| Inferred | 1,735 | 1.74 | 97 | 6.88 | 384 | 0.60 | 22,959 |

Notes:

| |||||||

Mineral Reserves

The PFS describes the mineral reserve estimation methodology and summarizes the key assumptions used, and to which this estimate is subject. The qualified person responsible for the mineral reserve is John M. Marek, P.E., of Independent Mining Consultants, Inc. Mr. Marek concluded that he is not aware of any unique conditions that would put the Stibnite Gold mineral reserve at a higher level of risk than other North American developing projects. The probable mineral reserve is a subset of the mineral resource comprising only indicated mineral resource blocks that contribute positive economic value, based on gold values only, and that are planned for processing during the life-of-mine plan. In order to maximize profitability early in the mine life, the Yellow Pine pit was constrained in a floating cone using an $800/oz gold price, while the Hangar Flats and West End pits were constrained in floating cones using an $1,100/oz gold price.

Table 4: Stibnite Gold Project Probable Mineral Reserve Estimate

| Deposit | Tonnage (000s st) | Average Contained Grade | Total Contained Metal | ||||

|---|---|---|---|---|---|---|---|

| Gold (oz/st) | Antimony (%) | Silver (oz/st) | Gold (000s oz) | Antimony (000s lbs) | Silver (000s oz) | ||

| Yellow Pine | 43,985 | 0.057 | 0.098 | 0.090 | 2,521 | 86,376 | 3,973 |

| Hangar Flats | 15,430 | 0.045 | 0.132 | 0.086 | 690 | 40,757 | 1,327 |

| West End | 35,650 | 0.035 | 0.000 | 0.040 | 1,265 | - | 1,410 |

| Historic Tailings | 3,001 | 0.034 | 0.165 | 0.084 | 102 | 9,903 | 252 |

| Total Probable Mineral Reserve(1) | 98,066 | 0.047 | 0.070 | 0.071 | 4,579 | 137,037 | 6,962 |

Notes:

| |||||||

Mineral reserves exclude approximately 9.7 million metric tonnes with average grades of 1.10 g/t Au, 1.67 g/t Ag and 0.04% Sb (in imperial units, this equates to 10.8 Mst grading 0.032 oz/t Au, 0.049 oz/t Ag and 0.04% Sb) that are inferred mineral resources that lie within the mineral reserve pit limits; conversion of some or all of these tons would increase payable metal and reduce strip ratios. Mineral resources are not mineral reserves and do not have demonstrated economic viability. Inferred mineral resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these inferred mineral resources will be converted to the measured and indicated categories through further drilling, or into mineral reserves, once economic considerations are applied.

LOM Open Pit Production Schedule

Individual mine plans were developed for each of the Hangar Flats, West End, Yellow Pine and Historic Tailings deposits. The LOM plan is summarized in Table 13, which is attached at the end of this news release and illustrated in Figures 1 & 2 below. The PFS mine plan schedules 95.1 Mst of ore to be fed to the processing plant from Yellow Pine, Hangar Flats and West End pits and an additional 3.0 Mst of historic tailings. Each of the three in situ deposits is mined in phases to reduce the upfront waste rock removal. The mining sequence generates a waste rock:ore stripping ratio that averages 3.5:1 over the LOM, including the historic tailings which have a stripping ratio of 2.0:1 (the spent heap leach ore stripped off the historic tailings would be reused for construction purposes).

Figure 1: Stibnite Gold Project - Ore, Waste Movements & Ounces of Contained Gold Mined by Year

Figure 2: Stibnite Gold Project - Ore Mining Schedule by Deposit and Phase

Processing

The gold in the deposits is primarily contained within pyrite and (to a much lesser extent) arsenopyrite. As a result, the ore would be crushed, ground and sulfides recovered by sequential flotation. Stibnite (when antimony grades warrant) would be recovered into an antimony concentrate for sale to third parties and gold into a gold-sulphide concentrate. The gold sulfide concentrate would be pressure oxidized in an onsite POX plant and gold would be recovered as doré. The gold flotation process is managed to optimize sulphur and gold grades, to ensure optimal performance and throughput of the autoclave, with autothermic feed and minimal requirement for cooling water. The ore is of medium hardness, with bond ball mill work indexes ranging from 13.0 to 14.1 kWh/t.

The overall gold recoveries to doré are expected to average approximately 90% from Yellow Pine, 87% from Hangar Flats, 86% from West End, and 75% from the Historic Tailings. When processing material containing more than 0.1% Sb, antimony recoveries are expected to average 82% for Hangar Flats and 87% for Yellow Pine, with minor gold and silver contained in the antimony concentrate.

Tailings & Waste Rock Management

Mine waste requiring on-site management includes waste rock from the three open pits, flotation and POX tailings from ore processing, and historic mine waste (spent heap leach ore, historical tailings and historic waste rock dumps) exposed during construction and mining. The majority of the existing historic tailings would be reprocessed and subsequently commingled with the rest of the tailings. A single Tailings Storage Facility (“TSF”) would be constructed for all tailings from the processing of the various ore types. The TSF would consist of a rockfill dam and a geosynthetic lined impoundment that would be constructed in stages throughout the Project life. A majority of the waste rock would be deposited in the main Waste Rock Storage Facility (“WRSF”), used as rockfill in TSF construction, or placed as backfill within mined-out areas of the open pits to facilitate closure and reclamation. The main WRSF would be located at the foot of the TSF dam and would act as a buttress to enhance dam stability. Current test work indicates no need for special handling of any of the waste rock materials. The TSF dam and WRSF, combined, would hold 210 Mst of waste rock and overburden. Most of the waste rock from the West End pit (130 Mst) would be used to backfill the Yellow Pine pit (111 Mst), with the remainder placed at the TSF, main WRSF and West End WRSF.

Capital Costs

Capital costs (“CAPEX”) were estimated based on Q3 2014, un-escalated US dollars and are summarized in Table 5 below. Vendor quotes were obtained for all major equipment. Some of the costs were developed from first principles, while some were estimated based on factored references and experience with similar projects.

Table 5: Stibnite Gold Project - Capital Cost Estimate

| Area | Detail | Initial CAPEX ($000s) | Sustaining CAPEX ($000s) | Closure CAPEX ($000s) | Total CAPEX ($000s) |

|---|---|---|---|---|---|

| Direct Costs | Mine Costs | 47,552(1) | 35,346 | - | 82,898 |

| Processing Plant | 336,219 | 1,579 | - | 337,798 | |

| On-Site Infrastructure | 149,245 | 39,937 | - | 189,182 | |

| Off-Site Infrastructure | 80,327 | - | - | 80,327 | |

| Indirect Costs | 176,687 | 4,275 | - | 180,962 | |

| Owner’s Costs | 26,806 | - | - | 26,806 | |

| Environmental Mitigation Costs | 10,606 | 8,165 | - | 18,771 | |

| Closure Bonding, Closure and Reclamation Costs | 762 | 9,185 | 56,542 | 66,489 | |

| Total CAPEX without Contingency | 828,204 | 98,488 | 56,542 | 983,233 | |

| Contingency | 142,050 | - | - | 142,050 | |

| Total CAPEX with Contingency | 970,254 | 98,488 | 56,542 | 1,125,283 | |

Note:

| |||||

Mitigation costs only refer to relocation of a certain portion of the readily identifiable and quantified waste from historical mining activities; other costs related to recovery and reprocessing of historic tailings and relocation of unquantified waste rock at West End and Yellow Pine are included in operating costs and are largely offset by recovery of gold and antimony from the historic tailings.

Operating Costs

Operating cost estimates (“OPEX”) were developed based on Q3 2014, un-escalated US dollars and are summarized in Table 6 below. Most costs were developed from first principles while some were estimated based on factored references and experience with similar projects.

Table 6: Stibnite Gold Project - Cash Operating Cost Estimate

| Cash Operating Cost Estimate | Life-Of-Mine Average | Years 1-4 Average | |||

|---|---|---|---|---|---|

| $/st mined | $/st milled | $/oz Au | $/st milled | $/oz Au | |

| Mining OPEX(1) | 2.00 | 9.08 | 222 | 10.04 | 222 |

| Processing OPEX | - | 14.45 | 354 | 14.10 | 312 |

| General & Administrative OPEX | - | 3.13 | 77 | 3.01 | 67 |

| Cash Costs(2)(3) | - | 26.65 | 653 | 27.15 | 601 |

| By-product credits | - | -3.45 | -85 | -5.32 | -118 |

| Cash Costs after by-product Credits(3) | - | 23.20 | 568 | 21.83 | 483 |

Notes:

| |||||

Production Schedule

Recovered metal production totals 4.04 million oz gold, 2.1 million oz silver and 99.9 million lbs antimony, as summarized in Table 6 and illustrated on an annual basis in Figure 3.

Table 6: Stibnite Gold Project - Recovered Metal Production

| Product by Deposit | Gold (000s oz) | Silver (000s oz) | Antimony (000s lbs) |

|---|---|---|---|

| Doré Bullion | |||

| Yellow Pine | 2,263 | 338 | - |

| Hangar Flats | 597 | 68 | - |

| West End | 1,090 | 681 | - |

| Historic Tailings | 72 | 20 | - |

| Doré Bullion Recovered Metal Totals | 4,023 | 1,107 | - |

| Antimony Concentrate | |||

| Yellow Pine | 12 | 611 | 69,822 |

| Hangar Flats | 5 | 349 | 30,030 |

| Antimony Concentrate Recovered Metal Totals | 17 | 960 | 99,852 |

| Total Recovered Metals | 4,040 | 2,067 | 99,852 |

Figure 3: Stibnite Gold Project - Recovered Metal Production by Year

Economic Analysis

Four potential cash flow cases were studied using metal prices summarized in Table 7 below. All cash flow cases used the same mineral reserve estimate, mine plan and production factors, as summarized in Table 8 below.

Table 7: Stibnite Gold Project - Metal Price Assumptions for the Four Economic Cases

| Case | Metal Prices | Basis | ||

|---|---|---|---|---|

| Gold ($/oz) | Silver(1) ($/oz) | Antimony(1) ($/lb) | ||

| Case A | 1,200 | 20.00 | 4.00 | Lower-bound case that reflects the lower prices over the past 36 months and spot on December 1, 2014. |

| Case B (Base Case) | 1,350 | 22.50 | 4.50 | Approximate 24-month trailing average gold price as of December 1, 2014. |

| Case C | 1,500 | 25.00 | 5.00 | Approximate 48-month trailing average gold price as of December 1, 2014. |

| Case D | 1,650 | 27.50 | 5.50 | An upside case to show Project potential at metal prices approximately 20% higher than the base case. |

Note:

| ||||

Table 8: Stibnite Gold Project - Summary of Production Statistics - All Cases

| Item | Unit | Value |

|---|---|---|

| General LOM Production Statistics | ||

| Waste Rock Mined | Mst | 346.7 |

| Ore Mined (including historic tailings) | Mst | 98.1 |

| Strip Ratio (waste rock tons : ore tons) | st:st | 3.5:1 |

| Daily Mill Throughput | st/d | 22,050 |

| Annual Mill Throughput | Mst/y | 8.05 |

| Mine Life | production years | 12 |

| LOM Mill Feed & Average Head Grade | ||

| Tons | Mst | 98.1 |

| Gold | oz/st Au | 0.047 |

| Silver | oz/st Ag | 0.071 |

| Antimony | % Sb | 0.070 |

| LOM Concentrate Production | ||

| Antimony Concentrate | dry st | 84,620 |

| LOM Payable Metal | ||

| Gold (99.5% metal payability on Dore) | 000s oz | 4,006 |

| Silver (98.0% metal payability on Dore) | 000s oz | 1,467 |

| Antimony (68% metal payability on concentrate) | 000s lbs | 67,900 |

A detailed breakdown of the various measures of cash cost over the life of the mine are shown in Table 9. The mining unit costs are presented in $/st mined, while all costs are presented in $/st milled, and in $/oz Au.

Table 9: Stibnite Gold Project - Total Production Cost Summary - Base Case

| Total Production Cost Item | LOM | Years 1-4 | |||

|---|---|---|---|---|---|

| ($/st mined) | ($/st milled) | ($/oz Au) | ($/st milled) | ($/oz Au) | |

| Mining | 2.00 | 9.08 | 222 | 10.04 | 222 |

| Processing | 14.45 | 354 | 14.10 | 312 | |

| G&A | 3.13 | 77 | 3.01 | 67 | |

| Cash Costs Before By-Product Credits(3) | 26.65 | 653 | 27.15 | 601 | |

| By-Product Credits | -3.45 | -85 | -5.32 | -118 | |

| Cash Costs After By-Product Credits(3) | 23.20 | 568 | 21.83 | 483 | |

| Royalties | 0.94 | 23 | 0.34 | 23 | |

| Refining and Transportation | 0.25 | 6 | 1.04 | 8 | |

| Total Cash Costs(3) | 24.38 | 597 | 23.20 | 513 | |

| Sustaining CAPEX | 1.00 | 24 | 0.52 | 11 | |

| Salvage | -0.27 | -7 | 0.00 | 0 | |

| Property Taxes | 0.04 | 1 | 0.04 | 1 | |

| All-In Sustaining Costs(3) | 25.15 | 616 | 23.76 | 526 | |

| Reclamation and Closure(1) | 0.58 | 14 | |||

| Initial (non-sustaining) CAPEX(2) | 9.89 | 242 | |||

| All-In Costs(3) | 35.62 | 872 | |||

Notes:

| |||||

The results of the economic analysis are summarized in Table 10 below.

Table 10: Stibnite Gold Project - Economic Results by Case

| Parameter | Unit | Pre-tax Results | After-tax Results |

|---|---|---|---|

| Case A ($1,200/oz Au, $20.00/oz Ag, $4.00/lb Sb) | |||

| NPV0% | $ millions | 1,286 | 1,041 |

| NPV5% | $ millions | 662 | 513 |

| IRR | % | 16.2 | 14.4 |

| Payback Period | Production Years | 4.0 | 4.1 |

| Case B ($1,350/oz Au, $22.50/oz Ag, $4.50/lb Sb) - Base Case | |||

| NPV0% | $ millions | 1,915 | 1,499 |

| NPV5% | $ millions | 1,093 | 832 |

| IRR | % | 22.0 | 19.3 |

| Payback Period | Production Years | 3.2 | 3.4 |

| Case C ($1,500/oz Au, $25.00/oz Ag, $5.00/lb Sb) | |||

| NPV0% | $ millions | 2,543 | 1,929 |

| NPV5% | $ millions | 1,524 | 1,129 |

| IRR | % | 27.2 | 23.4 |

| Payback Period | Production Years | 2.6 | 2.9 |

| Case D ($1,650/oz Au, $27.50/oz Ag, $5.50/lb Sb) | |||

| NPV0% | $ millions | 3,171 | 2,344 |

| NPV5% | $ millions | 1,955 | 1,414 |

| IRR | % | 31.9 | 27.0 |

| Payback Period | Production Years | 2.2 | 2.5 |

| Notes: (1) NPV0% = Net present value at a 0% discount rate. (2) NPV5% = Net present value at a 5% discount rate. (3) IRR = internal rate of return. | |||

The undiscounted after tax cash flow for Case B is presented in Figure 4.

Figure 4: Stibnite Gold Project - Undiscounted After-Tax Cash Flow for Base Case

The contribution to the Project economics, by metal, is about 94% from gold, 5% from antimony, and less than 1% from silver. The payable metal value by year for the Base Case is summarized in Figure 5 below.

Figure 5: Stibnite Gold Project - Payable Metal Value by Year for the Base Case

Sensitivity Analysis

Sensitivity analyses were performed using metal prices, mill head grade, CAPEX, and OPEX as variables. The value of each variable was changed plus and minus 20% independently while all other variables were held constant. The results of the sensitivity analyses on the Project’s net present value at a 5% discount rate (“NPV5%”), before and after tax, are shown in Tables 11 and 12 below.

Table 11: Stibnite Gold Project - Pre-tax NPV5% Sensitivities by Case

| Case | Variable | Pre-tax NPV5% (Millions $) | ||

|---|---|---|---|---|

| -20% Variance | 0% Variance | 20% Variance | ||

| Case A | CAPEX | 862 | 662 | 463 |

| OPEX | 1,017 | 662 | 308 | |

| Metal Price or Grade | -27 | 662 | 1,352 | |

| Case B (Base Case) | CAPEX | 1,292 | 1,093 | 894 |

| OPEX | 1,447 | 1,093 | 739 | |

| Metal Price or Grade | 318 | 1,093 | 1,869 | |

| Case C | CAPEX | 1,723 | 1,524 | 1,325 |

| OPEX | 1,878 | 1,524 | 1,170 | |

| Metal Price or Grade | 662 | 1,524 | 2,386 | |

| Case D | CAPEX | 2,154 | 1,955 | 1,755 |

| OPEX | 2,309 | 1,955 | 1,600 | |

| Metal Price or Grade | 1,007 | 1,955 | 2,902 | |

Table 12: Stibnite Gold Project - After-tax NPV5% Sensitivities by Case

| Case | Variable | After-tax NPV5% (Millions $) | ||

|---|---|---|---|---|

| -20% Variance | 0% Variance | 20% Variance | ||

| Case A | CAPEX | 676 | 513 | 346 |

| OPEX | 760 | 513 | 239 | |

| Metal Price or Grade | -30 | 513 | 1,012 | |

| Case B (Base Case) | CAPEX | 980 | 832 | 674 |

| OPEX | 1,057 | 832 | 577 | |

| Metal Price or Grade | 244 | 832 | 1,357 | |

| Case C | CAPEX | 1,266 | 1,129 | 982 |

| OPEX | 1,341 | 1,129 | 903 | |

| Metal Price or Grade | 513 | 1,129 | 1,696 | |

| Case D | CAPEX | 1,548 | 1,414 | 1,277 |

| OPEX | 1,623 | 1,414 | 1,200 | |

| Metal Price or Grade | 770 | 1,414 | 2,035 | |

Employment

The Stibnite Gold Project could do much to improve the economic situation in Valley and Adams Counties, where unemployment rates are some of the highest in Idaho and wages some of the lowest in the US, averaging less than $28,000/year. Current mining related salaries in Idaho average $72,500/year. The Project could create more than 700 jobs in Idaho (400 direct and more than 300 indirect) during the first three years of construction and nearly 1,000 jobs in Idaho (500 direct and nearly 500 indirect) during 12 years of Project operations, generating aggregate annual payrolls of approximately $48 million/year during construction and $56 million/year during operations. Direct employment estimates are summarized in Figure 6.

Figure 6: Stibnite Gold Project - Annual Direct Employment by Department

Taxes

Taxes that would be paid directly by Midas Gold over the life of the Project, based on the assumptions in the PFS, are estimated at approximately $329 million in federal corporate income taxes, and $86 million in state corporate income, mine license and local taxes.

Additional direct, indirect and induced taxes that result from Midas Gold’s activities that would be paid by other taxpayers over the life of the Project, based on the assumptions in the PFS, are estimated at approximately $177 million in federal taxes (including payroll, excise, income and corporate), and $131 million in state and local taxes (including property, sales, excise, personal, corporate, and other).

Total direct, indirect and induced taxes are therefore estimated at $506 million in federal taxes and $218 million in state and local taxes, representing a significant contribution to the economy during the 15 year construction and operating life of the Project.

Figure 7: Stibnite Gold Project - Chart of Estimated Federal, State & Local Taxes - Base Case

Environmental

Midas Gold has designed the Project around restoration of the site, including re-establishing fish passage, reclamation and reprocessing unconstrained historical tailings, removal of unconstrained historical waste rock, reuse of historical spent ore piles for construction, restoring stream channels, and sediment control as summarized in the PFS. Facilities are largely sited on previously impacted ground and avoid riparian areas, limit stream crossings, and the main access route avoids large waterways. The Project also minimizes the number of people on site to reduce traffic, and re-establishes historic grid power to minimize fuel haulage and reduce greenhouse gas emissions. In some cases, new disturbance of previously impacted wetlands and streams would be unavoidable, and would be mitigated through a wetlands bank or similar entity. Midas Gold would continue to build on its strong record by continuing to proactively evaluate Best Management Practices and Standard Operating Procedures effectiveness, including a post-closure component.

Fish Passage & Habitat Improvement

A critical goal for Midas Gold is the incorporation of fisheries protection and habitat restoration components aimed at achieving a sustainable anadromous fishery for the first time since 1938, including passage of migrating salmon, steelhead, and trout to the headwaters of the watershed both during and after operations. Upon closure, the rebuilt river channel would feature wetlands and spawning grounds to improve the health of the riparian zone and to assist in the return of migratory fish. Midas Gold has also incorporated efforts to improve water quality by removing historic tailings, spent ore and waste rock and respectively reprocessing, reusing and relocating these materials, as well as developing sediment control features for Blowout Creek, currently a major contributor of sediment into the regional waterways, and replanting historically disturbed and forest fire affected areas to reduce sedimentation.

Closure

Once operations cease, extensive ongoing reclamation activities would be completed, creating enhanced surface water systems and suitable fisheries habitat. Midas Gold has identified 17 priority Project conservation components that form the basis of the conservation strategy that are summarized in the PFS. Closure strategy (Figure 12 attached) components include: construction of the new Burntlog Road (which effectively moves the primary transportation route away from major waterways), backfilling the Yellow Pine pit to a more natural topography, closure of historic mine workings on USFS lands, restoration of fish passage to the upper watershed, post-closure wetlands and stream habitat enhancement on top of the Meadow Creek TSF surface and reforestation of the Project area.

Mobile and salvageable equipment would be removed, and foundations broken up, covered and re-vegetated. The objective is to create a self-sustaining natural environment in which many of the historical impacts are addressed and which supports a healthy fish and wildlife population. Post-closure monitoring is planned for an extended period to ensure that these objectives are met.

Project Risks & Opportunities

A number of risks and opportunities are identified in the PFS; aside from industry-wide risks and opportunities (such as changes in capital and operating costs related to inputs like steel and fuel, metal prices, permitting timelines, etc.), Project specific risks and opportunities are summarized below.

Risks, for which additional information is required in order to mitigate:

Use of historical data in mineral resource estimates, which could affect these estimates;

Limited geotechnical data which could affect pit slopes or ground stability in infrastructure areas;

Loss of gold into antimony concentrates where there is potentially significantly lower payability;

Water management and chemistry, which could affect diversion and closure designs and/or the need for long term water treatment; and

Construction schedule.

Opportunities that could improve the economics of the Project include a number of mineral resource/reserve opportunities that have the potential to increase the after-tax NPV5% by more than $100 million. As illustrated in ‘Comparison to the 2012 PEA’ discussion below, 60% of the reduction in the Project’s NPV is related to less payable metal, which reduction could be reversed through the definition of additional mineral reserves. Opportunities for mineral reserve additions within the pits discussed above that would increase payable metal and reduce strip ratios, include the following:

Conversion of in pit mineral resources to mineral reserves;

Conversion of in pit unclassified material currently treated as waste rock to mineral reserves;

Improved grade of higher grade gold mineralization within the Yellow Pine pit, particularly around the area with excluded or limited use of historic data;

Additional antimony mineralization and/or grade in areas within the pits where some historical data was eliminated and/or areas where antimony was not assayed.

There is also potential for additions to mineral reserves from areas immediately adjacent to the pits discussed above, which could increase the payable metal, including:

Existing mineral resources on pit limits; and

Areas at West End where only CN assays were available.

Finally, there is further potential for mineral reserve additions from the definition and/or discovery of new deposits, which could also increase the payable metal, including potential for higher grade, higher margin underground mineral reserves at prospects such as Scout and Garnet, and for new bulk tonnage deposits at several other prospects with the Project area.

Opportunities with impact in the range of an estimated $10 million to $100 million increase in Project after-tax NPV5% include improved metallurgical recoveries, secondary processing of antimony concentrates, steeper pit slopes, onsite quicklime generation, and third party funding of off-site infrastructure. A number of other opportunities also exist, as summarized in the PFS.

Comparison to the 2012 PEA

Net Present Value

Changes in after-tax NPV5% for the PFS relative to the PEA, are summarized in Figure 8 below. Significant changes include a decrease in payable metal (60% of the decrease in NPV5%), decrease in metal prices (18%), increases to OPEX (11%) and the addition of a royalty (10%). The decrease in payable metal is partially a result of changing from using mineral resources in the PEA to mineral reserves (i.e. inferred mineral resources are excluded, as required for a PFS under NI 43-101) in addition to other changes in the mineral resource estimates for each of the deposits discussed above. Changes in OPEX are largely due to increases in electricity costs and consumption and grinding media consumption (resulting from finer grinding), and increases in unit mining costs largely related to leasing the mining fleet.

Figure 8: Stibnite Gold Project - Changes in LOM After-tax NPV5% from PEA to PFS

Changes in LOM CAPEX

Broad changes in the LOM CAPEX from the PEA to the PFS are summarized in Figure 9 below. Total LOM CAPEX in the PFS has been reduced by $57 million (5%) relative to the PEA, primarily related to reductions in the mining area and contingency, offset by increases in most other areas. Some costs have been aggregated in the chart below to allow direct comparison to the PEA LOM CAPEX.

Figure 9: Stibnite Gold Project - LOM CAPEX - Comparison of PEA to PFS

Principle causes of change in the LOM CAPEX from the PEA to the current PFS are reductions in mining related to leasing the mining fleet and a smaller Hangar Flats pit (eliminating stripping and additional equipment) and contingency (since the Project estimates are more refined), offset by increases in: the process plant CAPEX (related to design changes), onsite and offsite infrastructure related to power line and access road, mitigation and closure costs (related to better quantification of the requirements), and affected indirect costs.

Changes in LOM OPEX

Compared to the PEA, the PFS LOM unit operating costs have increased 28%, as illustrated in the chart below (Figure 10). Note that the PEA unit costs were in $ per metric tonne, whereas the costs for the PFS are in $ per short ton; for the comparison below, the PEA costs have been converted to $/st. Principal changes to LOM OPEX include reductions in by-product credits, leasing costs for mining equipment and more detailed mine planning, finer grinding, and addition of the Franco Nevada royalty, partially offset by reductions in G&A.

Figure 10: Stibnite Gold Project - LOM OPEX - Comparison of PEA to PFS

Conclusions & Recommendations

Industry standard mining, processing, construction methods, and economic evaluation practices were used to assess the Project. There was adequate geological and other pertinent data available to generate the PFS.

The PFS demonstrates that the Project is technically and environmentally sound and has the potential to generate positive economic returns based on the assumptions and conditions set out in the PFS. This conclusion warrants continued work to advance the Project to the next level of study, which is a Feasibility Study (“FS”) by conducting the work indicated in the recommendations section of the PFS. These recommendations form a single phase that would move the Project through to completion of a FS and, if so desired, through the regulatory process for mine development. Total estimated cost for completion of this single phase is $22.3 million and includes drilling, geotechnical work, additional metallurgical testing, more detailed engineering and continued environmental baseline and compliance work. While additional information is required for a complete assessment of the Project, at this point there do not appear to be any unique conditions that would put the Project at a higher level of risk than other North American developing projects. The PFS has achieved its original objective of providing a more detailed review of the potential economic viability of the Project.

The QPs of this PFS are not aware of any unusual, significant risks or uncertainties that could be expected to affect the reliability or confidence in the Project based on the data and information available to date.

Moving Forward

The PFS identifies a number of risks and opportunities, and makes certain recommendations for further work. In 2015, Midas Gold plans to follow up on these recommendations, and will initiate a process to engage in meaningful conversations with stakeholders with respect to the best way to move the Project forward.

Updated Technical Report

Midas Gold plans to file a NI 43-101 Technical Report on SEDAR by the end of 2014 detailing the information set out herein.

Compliance with National Instrument 43-101

Mineral resources that are not mineral reserves do not have demonstrated economic viability. Mineral resource estimates do not account for mineability, selectivity, mining loss and dilution. These mineral resource estimates include inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves. There is also no certainty that these Inferred mineral resources will be converted to the Measured and Indicated categories through further drilling, or into mineral reserves, once economic considerations are applied.

The mineral resources and mineral reserves at the Stibnite Gold Project are contained within areas that have seen historic disturbance resulting from prior mining activities. In order for Midas Gold to advance its interests at Stibnite, the Project will be subject to a number of federal, State and local laws and regulations and will require permits to conduct its activities. However, Midas Gold is not aware of any environmental, permitting, legal or other reasons that would prevent it from advancing the project.

Non-IFRS Performance Measure

“Cash Costs”, “All-in Sustaining Costs” and “Total costs” are non-IFRS Performance Measures. These performance measures are included because these statistics are key performance measures that management uses to monitor performance. Management uses these statistics to assess how the Project ranks against its peer projects and to assess the overall effectiveness and efficiency of the contemplated mining operations. These performance measures do not have a meaning within IFRS and, therefore, amounts presented may not be comparable to similar data presented by other mining companies. These performance measures should not be considered in isolation as a substitute for measures of performance in accordance with IFRS.

Conference Call & Webcast Details

Midas Gold will be hosting a conference call and webcast at 11:00 AM PST (2:00 PM EST) on Monday, December 15, 2014 to discuss highlights of the PFS on the Stibnite Gold Project and to provide analysts and investors the opportunity to ask questions; call in details are as follows:

Canada & USA Toll Free Dial In: 1-800-319-4610

Outside of Canada & USA call: +1-604-638-5340

Callers should dial in 5 - 10 min prior to the scheduled start time and simply ask to join the Midas Gold call.

Midas Gold will also webcast the presentation to accompany the discussion:

Click: http://ipresent.choruscall.com/FlexPresenter/

Enter your name

Enter Passcode: 77779

Quality Assurance

The technical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101 and reviewed and approved by Stephen P. Quin, P. Geo., President and CEO of Midas Gold Corp., and a Qualified Person. The QPs responsible for the PFS are set out below, with the general areas of responsibility provided (see the Technical PFS for details of responsibility).

Conrad E. Huss, P.E., M3 Engineering & Technology Corp. (introductory and background information, infrastructure, capital and operating costs, economic analysis, conclusions and recommendations);

Garth Kirkham, P. Geo, Kirkham Geosystems Ltd. (geology, drilling, data verification and mineral resource estimates);

Christopher Martin, C.Eng., Blue Coast Metallurgy Ltd. (mineral processing and metallurgical testing);

John M. Marek, P.E., Independent Mining Consultants Inc. (mineral reserves, mine planning and related capital and operating costs);

Allen R. Anderson, P.E., Allen R. Anderson Metallurgical Engineer Inc. (recovery methods);

Richard C. Kinder, P.E., HDR Engineering Inc. (access road); and

Peter E. Kowalewski, P.E., Tierra Group International Ltd. (climatology, hydrology, tailings and water management infrastructure, closure and related matters).

Forward-Looking Information

Statements contained in this news release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. Forward Looking Information includes, but is not limited to, disclosure regarding possible events, conditions or financial performance that is based on assumptions about future economic conditions and courses of action; the timing and costs of future activities on the Corporation’s properties, including but not limited to development and operating costs in the event that a production decision is made; success of exploration, development and environmental protection and remediation activities; permitting time lines and requirements; requirements for additional capital; requirements for additional water rights and the potential effect of proposed notices of environmental conditions relating to mineral claims; planned exploration and development of properties and the results thereof; planned expenditures and budgets and the execution thereof. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, “potential”, “confirm” or “does not anticipate”, “believes”, “contemplates”, “recommends” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. Statements concerning mineral resource and mineral reserve estimates may also be deemed to constitute Forward-Looking Information to the extent that they involve estimates of the mineralization that may be encountered if the Stibnite Gold Project is developed. In preparing the Forward-Looking Information in this news release, the Corporation has applied several material assumptions, including, but not limited to, that any additional financing needed will be available on reasonable terms; the exchange rates for the U.S. and Canadian currencies will be consistent with the Corporation’s expectations; that the current exploration, development, environmental and other objectives concerning the Stibnite Gold Project can be achieved and that its other corporate activities will proceed as expected; that the current price and demand for gold will be sustained or will improve; that general business and economic conditions will not change in a materially adverse manner and that all necessary governmental approvals for the planned exploration, development and environmental protection activities on the Stibnite Gold Project will be obtained in a timely manner and on acceptable terms; the continuity of the price of gold and other metals, economic and political conditions and operations. Forward-Looking Information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Corporation to be materially different from any future results, performance or achievements expressed or implied by the Forward-Looking Information. Such risks and other factors include, among others, the industry-wide risks and project-specific risks identified in the PFS and summarized above; risks related to the availability of financing on commercially reasonable terms and the expected use of proceeds; operations and contractual obligations; changes in exploration programs based upon results of exploration; changes in estimated mineral reserves or mineral resources; future prices of metals; availability of third party contractors; availability of equipment; failure of equipment to operate as anticipated; accidents, effects of weather and other natural phenomena and other risks associated with the mineral exploration industry; environmental risks, including environmental matters under US federal and Idaho rules and regulations; impact of environmental remediation requirements and the terms of existing and potential consent decrees on the Corporation’s planned exploration and development activities on the Stibnite Gold Project; certainty of mineral title; community relations; delays in obtaining governmental approvals or financing; fluctuations in mineral prices; the Corporation’s dependence on one mineral project; the nature of mineral exploration and mining and the uncertain commercial viability of certain mineral deposits; the Corporation’s lack of operating revenues; governmental regulations and the ability to obtain necessary licences and permits; risks related to mineral properties being subject to prior unregistered agreements, transfers or claims and other defects in title; currency fluctuations; changes in environmental laws and regulations and changes in the application of standards pursuant to existing laws and regulations which may increase costs of doing business and restrict operations; risks related to dependence on key personnel; and estimates used in financial statements proving to be incorrect; as well as those factors discussed in the Corporation’s public disclosure record. Although the Corporation has attempted to identify important factors that could affect the Corporation and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information.

Except as required by law, the Corporation does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

Note to US Investors

This news release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of United States securities laws. The terms “mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43 101; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. In addition, the terms “mineral reserve” and “probable mineral reserve” are also defined in accordance with NI43-101 and not Guide 7. Investors are cautioned not to assume that all or any part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category or converted into mineral reserves in accordance with Guide 7. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a mineral resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC Industry Guide 7 standards as in place tonnage and grade without reference to unit measures. Accordingly, information contained in this News Release contain descriptions of the Company’s mineral deposits that may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

Figure 11: Stibnite Gold Project - Conceptual Site Layout

Figure 12: Stibnite Gold Project - Conceptual Post Closure Reclamation

Table 13: Mine Production Schedule and Process Plant Metallurgical Recovery Summary

MIDAS GOLD TO ANNOUNCE RESULTS OF PREFEASIBILITY STUDY ON DECEMBER 15, 2014

Will Host Conference Call and Webcast

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) today reported that it will announce the results of the preliminary feasibility study (“PFS”) on its Stibnite Gold Project (the “Project”) located in Valley County, Idaho before markets open on Monday December 15, 2014.

Midas Gold will also be hosting a conference call and webcast at 11:00 AM PST (2:00 PM EST) on Monday, December 15, 2014 to discuss highlights of the Stibnite Gold Project PFS and to provide analysts and investors the opportunity to ask questions; call in details are as follows:

Canada & USA Toll Free Dial In: 1-800-319-4610

Outside of Canada & USA call: +1-604-638-5340

Callers should dial in 5 - 10 min prior to the scheduled start time and simply ask to join the Midas Gold call.

Midas Gold will also webcast the presentation to accompany the discussion:

Click: http://ipresent.choruscall.com/FlexPresenter/

Enter your name

Enter Passcode: 77779

About Midas Gold

Midas Gold Corp., through its wholly owned subsidiaries Midas Gold, Inc. and Idaho Gold Resources, LLC, is focused on the exploration and, if warranted, development of deposits in the Stibnite-Yellow Pine district of central Idaho. The principal gold deposits identified to date within the Project are the Hangar Flats, West End and Yellow Pine deposits, all of which are associated with important structural corridors, as well as a mineral resource contained in historic tailings.

MIDAS GOLD APPOINTS IDAHO-BASED DIRECTORS

Returning to its Historic Roots, Project to be called the “Stibnite Gold Project” Going Forward

VANCOUVER, BRITISH COLUMBIA - Midas Gold Corp. (TSX:MAX / OTCQX:MDRPF) and its wholly-owned Idaho-based subsidiary Midas Gold Idaho, Inc. (“Midas Gold, Inc.”) (collectively, “Midas Gold”) today appointed prominent local community members to Midas Gold Corp.’s and Midas Gold, Inc.’s boards of directors, adding a significant level of local representation and accountability at all levels of the organization. In addition, local community input has resulted in a decision to use the name “Stibnite Gold Project” (the “Project”) going forward in order to reflect the Project’s historic and local name, and maintain continuity with the storied past of this important mining district located in Valley County, Idaho.

Midas Gold Board Appointments

As part of its objective of increasing local accountability and representation in all its activities, Midas Gold today announced the appointment of several US-based directors at both the parent and subsidiary levels, significantly increasing the representation from Valley County and Idaho. Boise residents Laurel Sayer and Keith Allred have been appointed to the Board of Directors of Midas Gold Corp., while Valley County residents Don Bailey, Frank Eld, Scott Davenport and Ronn Julian, as well as Denver resident Kenneth Brunk have been appointed to the Board of Directors of Midas Gold, Inc., Midas Gold Corp.’s wholly-owned Idaho subsidiary that will manage activities at the Stibnite Gold Project going forward.

“The best way for our project to reflect the needs and values of Valley County and Idaho is to have genuine representation from these areas at all levels of our decision-making process,” said Stephen Quin, President & CEO of Midas Gold Corp. “We are excited that these Idahoans have agreed to help guide us in shaping the future of Midas Gold and the Stibnite Gold Project.”

Midas Gold Corp. Board of Directors

The appointment of Mr. Allred and Ms. Sayer brings an Idaho-based environmental and sustainable development perspective directly to the Midas Gold Corp. Board of Directors. Both have distinguished themselves as seasoned political professionals and conservationists who will work to ensure that economic development is also protective of the natural environment, which is of great importance not only to Midas Gold and its employees, but to Idaho and the Nation. The appointment of Mr. Allred and Ms. Sayer increases the Board of Midas Gold Corp. to nine directors, with a broad representation from the US, Canada and the UK, and considerable depth of experience in capital markets, corporate governance, exploration, operations, mine development, environmental protection, sustainable development and financial reporting.

“We are extremely pleased that Keith Allred and Laurel Sayer have agreed to join the Midas Gold Corp. Board of Directors,” said Mr. Quin. “While our Board and management team have always been focused on ensuring that Midas Gold conducts itself in a sustainable, environmentally conscious manner, these new directors will bring a valuable Idaho perspective that can only come from people who live in Idaho.”

Keith Allred is a partner at the Cicero Group, a 200-person leading strategy consulting and market research firm based in Salt Lake City and is also the founder and a director of The Common Interest, a citizens’ group of more than 1,700 Republicans, Democrats, and independents. In 2014, he founded Common Sense PAC with top Idaho business leaders and retired Republican lawmakers. Within Idaho, Mr. Allred is notable for being the 2010 Democratic candidate for Governor of Idaho. Mr. Allred has also served as a professor at Harvard’s Kennedy School of Government, Oxford’s Said School of Business, and at Columbia University, he holds a PhD in Organizational Behavior from the Anderson School of Management at UCLA and BA in American History from Stanford University.

Laurel Sayer currently serves as Executive Director of the Idaho Coalition of Land Trusts and also serves on the Idaho Non-profit Center Board of Directors. Previously, Ms. Sayer spent more than two decades working with the Idaho congressional delegation, most recently in Idaho as the director of natural resource issues and policy for Congressman Mike Simpson. Ms. Sayer served on the Greater Idaho Falls Chamber of Commerce from 2003 to 2009, including serving as chair from 2007 to 2008. She was appointed by Governor C.L. “Butch” Otter to the Idaho Commission on the Arts, and served as vice-chair from 1999 to 2014, and also served as chair and vice-chair of the Idaho Falls Arts Council from 1999 to 2012. Ms. Sayer has developed substantial expertise in building consensus amidst diverse opinions and political ideologies of key stakeholders in a variety of situations, successfully creating meaningful relationships with local, state, regional and federal government agencies.

Midas Gold, Inc. Board of Directors

Midas Gold, Inc. is an Idaho-registered company with a board of six directors and a dedicated workforce of US-based personnel working on the Stibnite Gold Project. Midas Gold has centralized its operations in Idaho, with its main office located in the Valley County town of Donnelly and a satellite office located in Boise, Idaho. A camp with a seasonal exploration office is maintained near the historic Stibnite town site. Investor Relations and corporate activities for Midas Gold Corp. will remain in the Vancouver, BC, office, in order to be closer to the capital markets.

“Midas Gold, Inc. has been established to serve as the Idaho-based entity to manage all of the Company’s affairs in Idaho going forward, including the Stibnite Gold Project; this will ensure the centralization of decision-making, accountability and representation in one organization,” said Mr. Quin. With Valley County residents forming a majority on the Midas Gold, Inc. Board of Directors, Midas Gold will continue to be an integral part of that community. “We believe that, with five years of good practice, we have established ourselves as good neighbors who have demonstrated our focus on protecting the environment, promoting safe working practices, hiring and contracting locally where possible, and participating in and contributing to community life,” said Mr. Quin. “The Board composition is one more demonstration of our commitment to ensuring accountability through community oversight, input, and representation.”